Discover Private Wealth Management Advisors And Firms For Financial Guidance

In an increasingly complex financial landscape, private wealth management advisors and firms play a crucial role in helping individuals and families manage their finances, plan for the future, and achieve their financial goals.

1. Understand Wealth Management Services:

Wealth management encompasses a broad range of financial services, including investment management, retirement planning, tax planning, estate planning, and risk management. Understand the specific services you need based on your financial situation and goals.

2. Assess Your Financial Goals:

Clearly define your financial objectives, whether it's growing your investment portfolio, planning for retirement, funding your children's education, or managing your estate. Knowing your goals will help you find a wealth management advisor who specializes in your areas of interest.

3. Research Reputable Firms and Advisors:

Start by researching reputable wealth management firms and advisors. Look for firms with a strong track record, solid reputation, and positive client testimonials. Resources such as the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC) can provide valuable information about advisors' credentials and disciplinary history.

4. Evaluate Qualifications and Expertise:

Ensure that the advisors you consider have the necessary qualifications and expertise. Look for certifications such as Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Certified Private Wealth Advisor (CPWA). These designations indicate a high level of competency and ethical standards.

5. Consider the Firm's Approach and Philosophy:

Different wealth management firms may have varying investment philosophies and approaches. Some may focus on active management and individual stock selection, while others may prioritize passive management and diversified portfolios. Choose a firm whose approach aligns with your risk tolerance and investment preferences.

6. Review Fee Structures:

Wealth management services can come with various fee structures, including asset-based fees, hourly rates, or commission-based fees. Understand how the advisor is compensated and ensure there are no conflicts of interest that could affect the quality of advice you receive.

7. Assess Client-Adviser Relationship:

A strong client-adviser relationship is crucial for effective wealth management. Choose an advisor who takes the time to understand your financial situation, listens to your concerns, and communicates clearly. Personal rapport and trust are essential for a successful long-term partnership.

8. Ask for Referrals and Testimonials:

Ask friends, family, or colleagues for referrals to trusted wealth management advisors. Additionally, request testimonials or case studies from potential advisors to understand how they have helped clients with similar financial goals.

9. Evaluate Technological Tools and Resources:

Modern wealth management firms often utilize advanced technology and tools to enhance their services. Look for firms that offer user-friendly online platforms, financial planning software, and secure communication channels to manage your finances efficiently.

10. Schedule Initial Consultations:

Before making a decision, schedule initial consultations with a few shortlisted advisors. Use these meetings to discuss your financial goals, ask questions about their services, and assess their approach and compatibility.

By following these steps and conducting thorough research, you can discover the right private wealth management advisors and firms to provide the financial guidance you need. A competent and trustworthy wealth management advisor can help you navigate the complexities of financial planning, ensuring your wealth is managed effectively for long-term success.

Explore

Get Cheap or Free Financial Advice with Professional Financial Advisors

Find The Best Retirement Planning Advisors Near You

Find Financial Freedom: Best Debt Relief Companies in the USA

Online Colleges That Accept Financial Aid: How to Fund Your Education

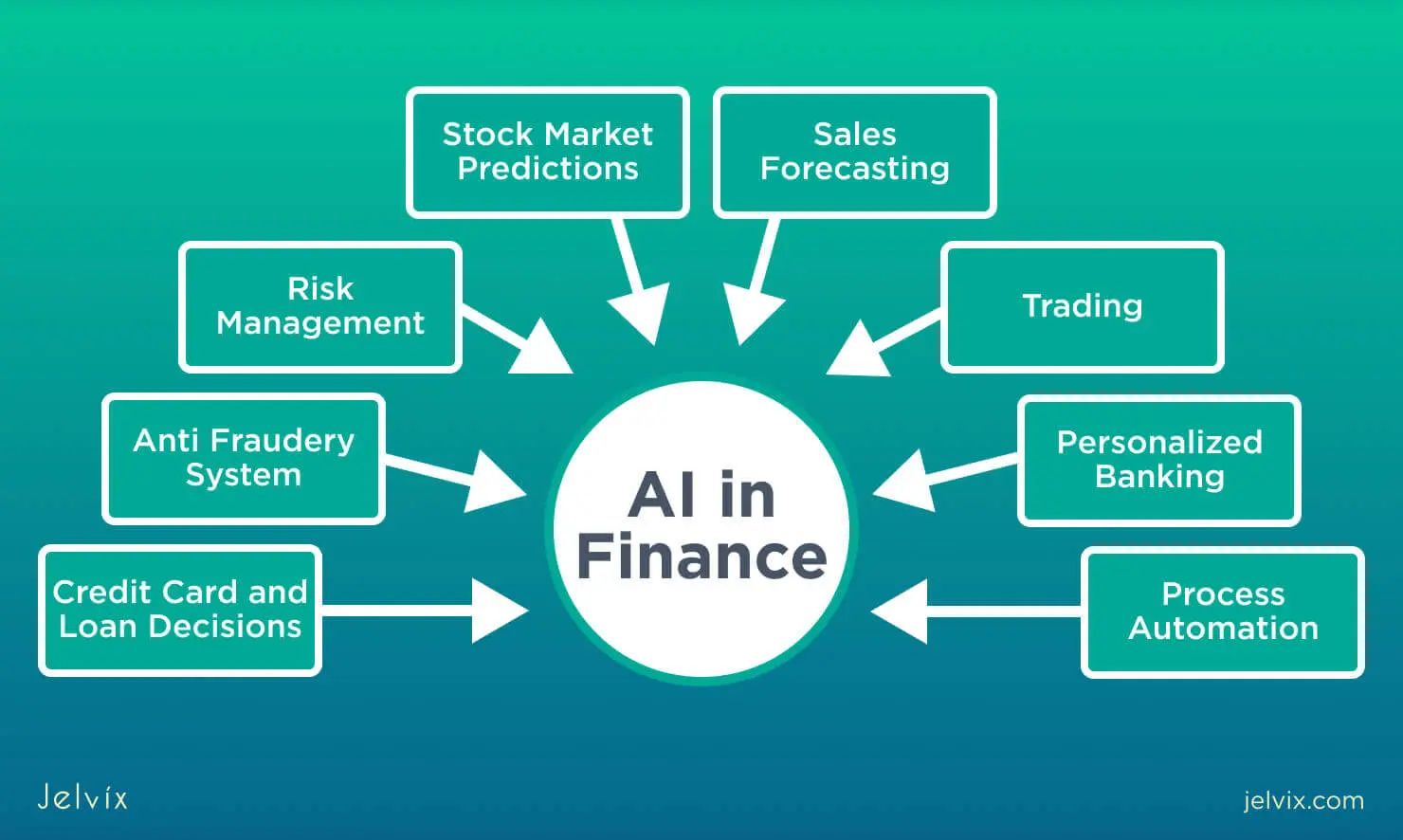

AI in Finance: Revolutionizing the Financial Industry

Discover the Leading Online Payment Processing Companies in the USA

Enterprise Password Manager: Enhance Security and Simplify Password Management

Guide To Finding The Right Warehouse Management Systems For Small Businesses