Get Cheap or Free Financial Advice with Professional Financial Advisors

Financial advice is crucial for making informed decisions about investments, savings, and managing your money effectively. There are several ways to access affordable or even free financial advice without compromising on quality.

1. Seek Out Non-Profit Organizations and Community Services

Many non-profit organizations and community centers offer free or low-cost financial counseling services. These organizations often have certified financial planners or advisors who volunteer their time to help individuals and families manage their finances. Check local community centers, churches, or non-profits dedicated to financial literacy for available resources.

2. Take Advantage of Employer Benefits

Some employers provide access to financial advisors as part of their benefits package. Employee assistance programs (EAPs) may include financial counseling services at no extra cost. Additionally, large companies often partner with financial firms to offer discounted or subsidized advisory services to their employees.

3. Utilize Government Resources

Government agencies and programs often provide free financial advice through various channels. For example, in the United States, the Consumer Financial Protection Bureau (CFPB) offers resources and tools for financial planning and education. Similarly, local government offices may host workshops or provide referrals to trusted financial advisors.

4. Explore Online Platforms

The internet offers a wealth of resources for obtaining financial advice at low or no cost. Many reputable financial advisors provide free initial consultations online or through virtual platforms. Websites and apps dedicated to personal finance often feature articles, calculators, and forums where users can seek advice from professionals or peers.

5. Consider Fee-Only Advisors

Fee-only financial advisors charge for their services based on an hourly rate or a flat fee rather than earning commissions from financial products they recommend. This fee structure can often be more cost-effective and transparent, as it eliminates potential conflicts of interest that may arise from commission-based compensation.

6. Attend Financial Education Workshops and Seminars

Financial institutions, universities, and community organizations frequently host workshops and seminars on various aspects of financial planning. These events may include sessions led by certified financial planners who provide valuable insights and guidance at little to no cost to attendees.

Conclusion

Accessing affordable financial advice is possible through a variety of channels, from non-profit organizations and employer benefits to online platforms and government resources. By exploring these options, individuals can make informed financial decisions without incurring high costs. Whether you're planning for retirement, managing debt, or investing for the future, seeking professional advice doesn't have to break the bank. Take advantage of these resources to secure your financial well-being and achieve your goals with confidence.

Explore

Discover Private Wealth Management Advisors And Firms For Financial Guidance

Find The Best Retirement Planning Advisors Near You

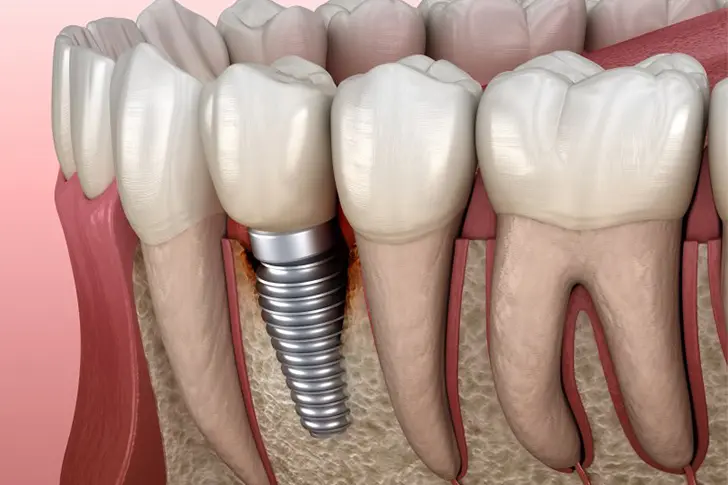

How To Find Cheap Dental Implant

Find the Best Plumbers with Free Estimates Near You

Master Essential Tech Skills with These Free Online Computer Courses and Earn a Certificate

Best Laser Hair Removal Near Me: Find Top Clinics for Smooth, Hair-Free Skin

Find the Best Tax Services Nearby to Get Your Taxes Done

How To Get Affordable Solar Roof Tiles