Find Financial Freedom: Best Debt Relief Companies in the USA

Achieving financial freedom often involves managing and eliminating debt, a process that can be greatly facilitated by the right debt relief company. With numerous options available, it’s important to choose a reputable and effective service provider. Here’s a guide to the best debt relief companies in the USA for 2025:

1. National Debt Relief

Overview: National Debt Relief is a well-established company known for its effective debt settlement services. They negotiate with creditors to reduce the total amount owed, helping clients become debt-free faster.

Features:

- Free consultation and no upfront fees.

- Personalized debt relief plans.

- Accredited by the American Fair Credit Council (AFCC).

- Positive customer reviews and high ratings for client satisfaction.

Pros:

- Proven track record with significant debt reductions.

- Transparent fee structure.

- Excellent customer support.

2. Freedom Debt Relief

Overview: Freedom Debt Relief offers comprehensive debt settlement services, focusing on helping clients resolve their unsecured debts through negotiation and consolidation.

Features:

- Tailored debt relief plans based on individual financial situations.

- No fees until a debt settlement is reached.

- Accredited by the Better Business Bureau (BBB) and AFCC.

Pros:

- Extensive experience in the industry.

- Strong customer support and educational resources.

- Proven success in reducing debt amounts.

3. Accredited Debt Relief

Overview: Accredited Debt Relief provides personalized debt settlement and consolidation services, working closely with clients to create manageable repayment plans.

Features:

- Free initial consultation.

- Customized debt relief strategies.

- Member of AFCC and the International Association of Professional Debt Arbitrators (IAPDA).

Pros:

- Flexible payment options.

- High client satisfaction ratings.

- Comprehensive educational materials.

4. CuraDebt

Overview: CuraDebt specializes in debt settlement and tax debt relief, offering a wide range of services to help clients manage their financial burdens.

Features:

- Expertise in both debt and tax relief.

- Free consultation with no upfront fees.

- Accredited by AFCC and IAPDA.

Pros:

- Experienced in handling complex debt situations.

- Personalized service with dedicated financial consultants.

- Strong focus on customer education.

5. New Era Debt Solutions

Overview: New Era Debt Solutions provides ethical and effective debt settlement services, focusing on transparent practices and client success.

Features:

- No upfront fees or hidden costs.

- Direct negotiation with creditors.

- Accredited by BBB and AFCC.

Pros:

- Strong reputation for ethical practices.

- Transparent fee structure.

- High success rate in debt reductions.

Choosing the Right Company

When selecting a debt relief company, consider the following factors:

- Accreditation and Reputation: Ensure the company is accredited by reputable organizations such as BBB, AFCC, or IAPDA.

- Fees and Costs: Look for companies that offer transparent fee structures and no upfront fees.

- Customer Reviews: Research customer testimonials and reviews to gauge satisfaction and success rates.

- Services Offered: Choose a company that offers the specific services you need, whether it's debt settlement, consolidation, or tax debt relief.

By carefully evaluating these factors, you can find a debt relief company that aligns with your financial goals and helps you achieve financial freedom in 2025.

Explore

Get Cheap or Free Financial Advice with Professional Financial Advisors

Discover the Leading Online Payment Processing Companies in the USA

Find Your Perfect Fit: The Best Checking Accounts in the USA

Discover Private Wealth Management Advisors And Firms For Financial Guidance

Online Colleges That Accept Financial Aid: How to Fund Your Education

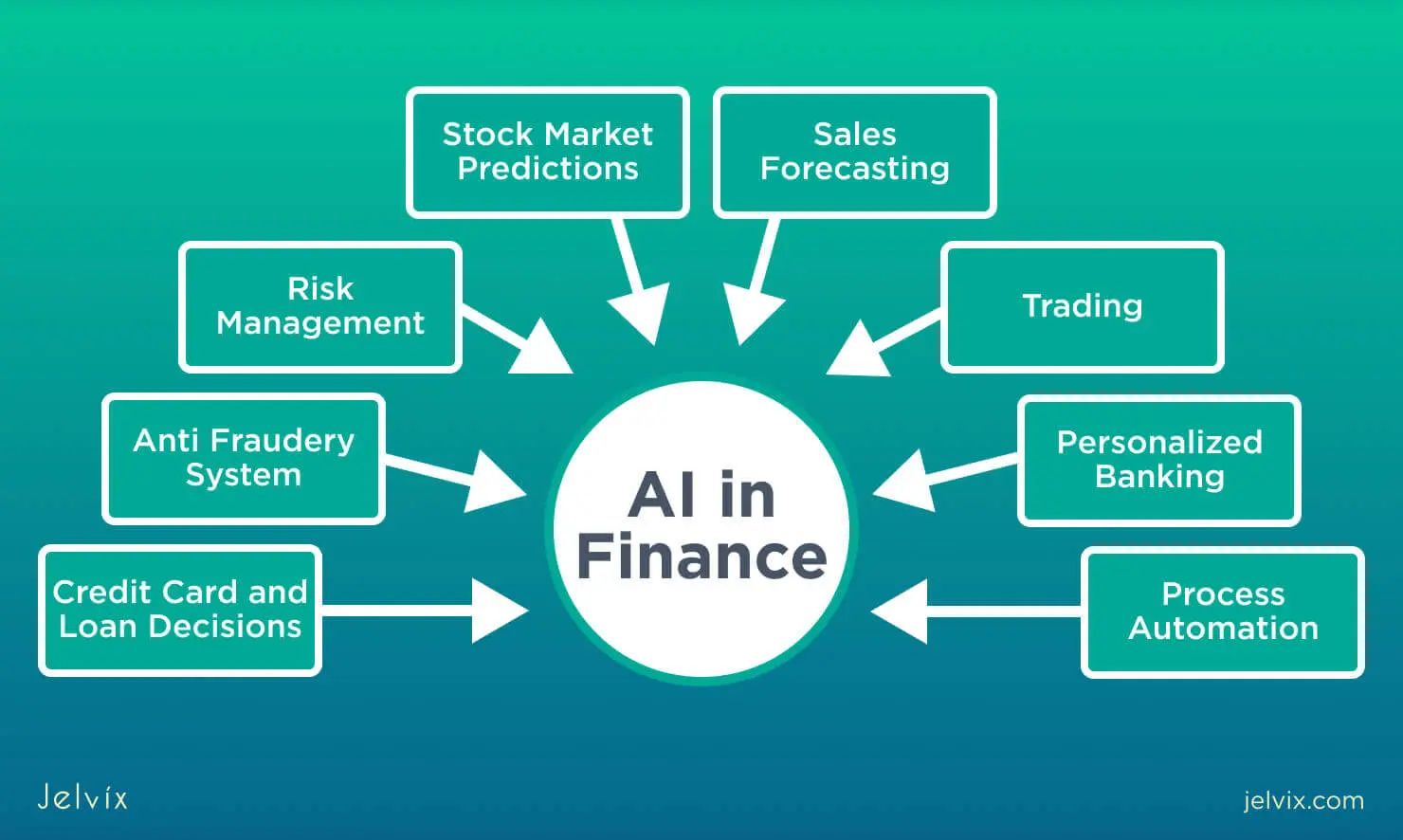

AI in Finance: Revolutionizing the Financial Industry

The Best 24-Hour Air Conditioning Repair Service Companies

lluminate Your Home: Finding the Best Window Companies in Your Area