How Charitable Donations Can Help You Save on Taxes in the USA

Charitable donations offer more than just the satisfaction of helping others—they can also provide significant tax benefits for individuals and businesses in the USA. By donating to qualified charitable organizations, taxpayers can reduce their taxable income and potentially lower the amount of taxes they owe. This article will explore how charitable donations can help you save on taxes, the requirements for making tax-deductible contributions, and how to maximize the tax benefits of your donations.

How Charitable Donations Affect Your Taxable Income

In the United States, donations made to qualifying charitable organizations can be deducted from your taxable income, which in turn reduces the amount of taxes you need to pay. When you file your tax return, you can claim these donations as itemized deductions. This means the more you donate, the less of your income will be subject to taxation. Here are key details about how charitable donations can impact your taxes:

1. Tax Deduction Eligibility

To be eligible for a tax deduction, your donation must go to a qualified charitable organization. This includes registered nonprofits, religious organizations, educational institutions, and more. You can verify the eligibility of the organization by checking its tax-exempt status with the IRS.

2. Itemized Deductions

Charitable donations must be itemized on your tax return to receive a deduction. If you take the standard deduction, you won't be able to claim donations. However, if your total itemized deductions exceed the standard deduction, you will benefit from a tax reduction based on your charitable contributions.

3. Limits on Deductions

The IRS sets limits on the amount of donations you can deduct, usually a percentage of your adjusted gross income (AGI). Typically, the limit is 60% of your AGI, but it can vary based on the type of donation and the receiving organization. Any contributions above the limit can be carried forward to future years.

Types of Donations That Qualify for Tax Deductions

Not all charitable donations are created equal when it comes to tax benefits. Different types of donations may have different tax implications. Below are some common donation types that qualify for tax deductions:

| Donation Type | Tax Deduction Details |

|---|---|

| Cash Donations | Cash donations are 100% tax-deductible, up to a certain percentage of your AGI. |

| Goods and Property | Donations of goods (clothing, electronics, etc.) are deductible at their fair market value. |

| Stocks and Bonds | Donating appreciated stocks can allow you to avoid paying capital gains tax on the gains. |

| Vehicle Donations | Donating a vehicle can qualify for a deduction based on its fair market value or the amount it sells for at auction. |

| Charitable Remainder Trusts | You can establish a trust that donates to a charity while still receiving income from it during your lifetime. |

How to Maximize Your Tax Savings with Charitable Donations

To get the most out of your charitable donations, it’s important to keep accurate records and be strategic about your contributions. Here are some tips for maximizing your tax savings:

| Tip | Description |

|---|---|

| Track All Donations | Keep detailed records of all donations, including receipts for cash donations and appraisals for non-cash items. |

| Donate Appreciated Assets | If you donate assets such as stocks or real estate that have appreciated in value, you can avoid paying capital gains tax while claiming a deduction for the full market value. |

| Bunch Your Donations | Consider grouping your charitable donations into one year to surpass the standard deduction and maximize your itemized deductions for that year. |

| Use Donor-Advised Funds | A donor-advised fund allows you to make a large donation in one year, receive a tax deduction, and distribute the funds to charities over time. |

| Check the Organization’s Status | Make sure the organization is a qualified 501(c)(3) charity, as donations to ineligible entities will not be deductible. |

Example of Tax Savings from Charitable Donations

To understand how charitable donations can impact your taxes, here’s an example of how someone might save money on taxes:

| Contribution Amount | Adjusted Gross Income (AGI) | Taxable Income | Tax Savings |

|---|---|---|---|

| $5,000 in cash donations | $50,000 | $45,000 | Reduces taxable income by $5,000, saving roughly $1,200 (based on 24% tax bracket). |

| $10,000 in appreciated stock | $60,000 | $50,000 | Taxpayer avoids paying capital gains tax on the stock appreciation and claims full $10,000 deduction. |

| $2,500 in donated goods | $40,000 | $37,500 | Reduces taxable income by $2,500, saving around $600 (based on 24% tax bracket). |

Conclusion: Giving Back and Saving on Taxes

Charitable donations provide a wonderful opportunity to support causes you care about while also receiving tax benefits. By donating to qualified organizations, keeping track of your contributions, and strategically planning your donations, you can maximize the tax deductions available to you. Whether you’re donating cash, property, or appreciated assets, the tax savings can add up, helping you save money while making a positive impact on your community.

Explore

Exploring the Different Ways to Donate in the USA

The Role of Donations in Addressing Poverty and Health Crises in the USA

The Social Impact of Donations: Changing Lives in the USA

Top Online Donation Platforms for Americans: Giving Made Easy

Samaritan's Purse Giving Options: Make a Difference Today

Donating in the USA: A Guide to Making a Difference

Donate Car to Charity: How Your Vehicle Can Make a Difference

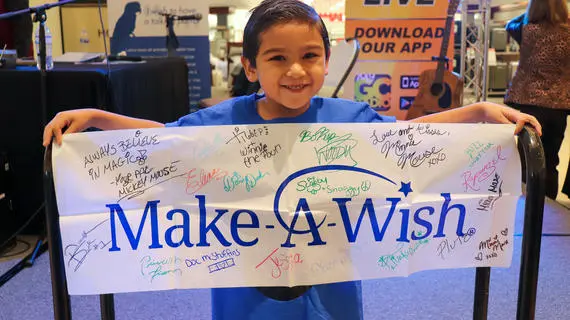

Make-A-Wish Foundation Donation: How Your Contribution Makes a Dream Come True