Donating in the USA: A Guide to Making a Difference

Donating in the USA is a powerful way to support communities, causes, and individuals in need. From charitable organizations to local nonprofits, the opportunities to contribute are vast and diverse. Whether you’re looking to make a one-time contribution, set up recurring donations, or explore tax benefits associated with charitable giving, understanding how to donate effectively is crucial. This article outlines the key aspects of donating in the United States and offers a comprehensive guide to maximize the impact of your generosity.

Why Donate in the USA?

Supporting charities and nonprofits in the U.S. benefits society in countless ways. Here are some key reasons why donating is important:

- Supporting Vulnerable Populations: Donations help provide essential resources such as food, shelter, and healthcare for those in need.

- Advancing Research and Innovation: Many donations fund breakthroughs in science, medicine, and technology.

- Tax Deductions: U.S. donors can often claim charitable contributions as deductions on their income tax returns.

Popular Ways to Donate in the USA

| Donation Method | Description | Examples |

|---|---|---|

| Online Donations | Contribute through websites or apps of charitable organizations. | GoFundMe, Charity Navigator |

| Donating Goods | Provide clothes, food, or other items to nonprofits. | Goodwill, local food banks |

| Recurring Contributions | Set up automatic monthly or annual donations to your favorite causes. | Red Cross, Habitat for Humanity |

| Corporate Matching | Some companies match employee donations, doubling the impact. | Programs offered by Google, Apple |

| Planned Giving | Include charities in your estate plan to leave a lasting legacy. | Bequests, charitable trusts |

| Peer-to-Peer Fundraising | Encourage friends and family to join your cause through crowdfunding campaigns. | Facebook Fundraisers, Kickstarter |

Steps to Donate Effectively

- Research the Charity: Use platforms like Charity Navigator or GuideStar to verify the legitimacy and efficiency of the organization.

- Understand Tax Benefits: Donations to qualified 501(c)(3) organizations are often tax-deductible. Keep receipts and records of your contributions.

- Decide How to Donate: Choose between monetary contributions, goods, or volunteering time.

- Set a Budget: Determine how much you can afford to give without compromising your financial stability.

- Consider Recurring Donations: These provide consistent support to organizations, allowing them to plan long-term initiatives.

Tax Benefits of Donating in the USA

| Type of Contribution | Tax Deduction Eligibility |

|---|---|

| Cash Donations | Fully deductible up to 60% of adjusted gross income (AGI) if given to 501(c)(3) organizations. |

| Non-Cash Donations | Fair market value of donated goods may be deductible if the organization is qualified. |

| Volunteer Expenses | Out-of-pocket expenses incurred while volunteering (e.g., mileage) may be deductible. |

| Stock and Securities | Donors may deduct the full fair market value and avoid capital gains tax. |

| Planned Giving | Estate tax deductions may apply for bequests to charities. |

Common Challenges and How to Overcome Them

- Charity Scams: To avoid fraud, donate only to well-established and verified organizations.

- Lack of Transparency: Ensure the charity provides detailed information about how funds are used.

- Overwhelming Choices: Narrow your options by focusing on causes you’re passionate about, such as education, healthcare, or the environment.

Conclusion

Donating in the USA is an impactful way to contribute to society while potentially enjoying financial benefits. By understanding the various methods of giving and researching reputable organizations, you can make informed decisions that maximize the effectiveness of your contributions. Whether you’re donating money, goods, or time, every act of generosity plays a role in building stronger communities and a better future.

Explore

Exploring the Different Ways to Donate in the USA

How Charitable Donations Can Help You Save on Taxes in the USA

The Role of Donations in Addressing Poverty and Health Crises in the USA

The Social Impact of Donations: Changing Lives in the USA

Top Online Donation Platforms for Americans: Giving Made Easy

Samaritan's Purse Giving Options: Make a Difference Today

Donate Car to Charity: How Your Vehicle Can Make a Difference

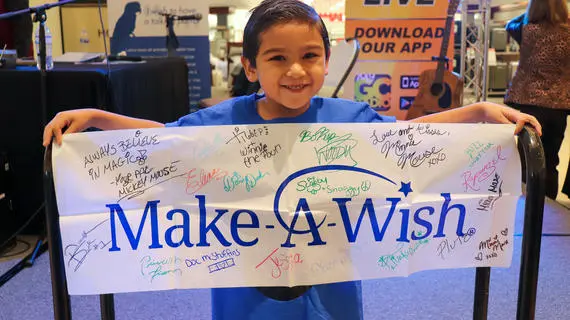

Make-A-Wish Foundation Donation: How Your Contribution Makes a Dream Come True