Exploring the Different Ways to Donate in the USA

Donating in the USA is an impactful way to contribute to causes you care about, whether it’s through charitable organizations, personal initiatives, or local communities. Donations not only help those in need but can also provide you with personal fulfillment and tax benefits. This article explores the different ways you can donate in the USA, including cash donations, donating goods, volunteering, and even donating through more innovative methods like cryptocurrency. Let’s dive into the options available to you.

Cash Donations: The Most Common Way to Give

One of the most straightforward ways to donate is through cash donations. These contributions are easy to make and often eligible for tax deductions. Whether through online platforms, check donations, or direct contributions to a charity’s donation box, cash donations help organizations carry out their programs and initiatives.

Benefits of Cash Donations:

- Simple and immediate.

- Often eligible for tax deductions.

- Can be given to any charity of choice.

Donating Goods and Items: A Practical Option

Another popular way to donate is by giving goods or items. This could include clothing, electronics, household items, and even furniture. Many charities accept these items, either directly from donors or through donation centers. For example, Goodwill and Salvation Army are organizations that often receive donations of goods.

Benefits of Donating Goods:

- Contribute to local communities or international causes.

- Can clear up space in your home.

- Tax deductions are possible for high-value donations.

| Type of Goods Donated | Examples | Tax Deductions |

|---|---|---|

| Clothing and Textiles | Clothing, shoes, and accessories | Tax-deductible at fair market value. |

| Electronics | Computers, TVs, mobile phones | Tax-deductible at fair market value. |

| Furniture and Appliances | Couches, refrigerators, dishwashers | Tax-deductible at fair market value. |

| Books and Educational Materials | Textbooks, novels, and study materials | Tax-deductible at fair market value. |

Volunteering: Time as a Valuable Donation

Sometimes, the most valuable donation is not monetary but your time. Volunteering at a local charity or nonprofit organization can have a huge impact on the community. Many people donate hours at food banks, animal shelters, or healthcare centers. While time spent volunteering isn’t directly deductible, there are other benefits such as fulfilling social impact and the potential to claim travel-related expenses.

Benefits of Volunteering:

- Directly contribute to community well-being.

- Can provide valuable experience and networking opportunities.

- Tax deductions for travel-related expenses (mileage, etc.).

Cryptocurrency Donations: A Modern Way to Contribute

As technology continues to evolve, new methods of donating have emerged. One of the newer ways to donate is through cryptocurrency. Many charities now accept donations in Bitcoin, Ethereum, and other digital currencies. This can be an attractive option for those who have cryptocurrency holdings and want to make a donation without liquidating their assets.

Benefits of Cryptocurrency Donations:

- Avoid paying capital gains tax on appreciated crypto assets.

- Easily track and transfer donations across borders.

- Available for various charitable organizations.

| Cryptocurrency Type | Charities Accepting Donations | Tax Benefits |

|---|---|---|

| Bitcoin | The Water Project, Red Cross | Can avoid paying capital gains tax on appreciated assets. |

| Ethereum | Save the Children, UNICEF | Can be donated directly to reduce taxable income. |

| Litecoin | WWF, GiveCrypto.org | Same benefits as Bitcoin, with faster transaction times. |

Payroll Giving: Workplace Giving Programs

Many employers offer payroll giving programs, which allow employees to donate a portion of their salary directly to a charity. This method makes donating automatic and helps employees easily contribute to causes they care about. The advantage is that the donation is often made before taxes are deducted, reducing the donor’s taxable income.

Benefits of Payroll Giving:

- Convenient and automatic deductions.

- Can help employees donate without extra effort.

- May be matched by employers, increasing the donation amount.

Online Platforms for Donation: Quick and Accessible

In today’s digital age, donating online has never been easier. Websites like GoFundMe, JustGiving, and DonorsChoose allow people to donate to causes they are passionate about with just a few clicks. Many platforms also provide options to donate monthly, helping to create a steady stream of funding for charities.

Benefits of Online Donation Platforms:

- Fast, secure, and easy process.

- Offers various payment options (credit card, PayPal, etc.).

- Can choose specific causes to support.

Conclusion: Multiple Ways to Make a Difference

As explored in this article, there are numerous ways to donate in the USA, whether through cash donations, goods, time, cryptocurrency, or online platforms. Each method has its unique benefits, and by choosing the right option, you can make a significant impact on the causes you care about while also reaping potential tax benefits. Whether you're donating once or setting up a recurring contribution, your generosity can help change lives and improve communities.

Explore

How Charitable Donations Can Help You Save on Taxes in the USA

The Role of Donations in Addressing Poverty and Health Crises in the USA

The Social Impact of Donations: Changing Lives in the USA

Top Online Donation Platforms for Americans: Giving Made Easy

Samaritan's Purse Giving Options: Make a Difference Today

Donating in the USA: A Guide to Making a Difference

Donate Car to Charity: How Your Vehicle Can Make a Difference

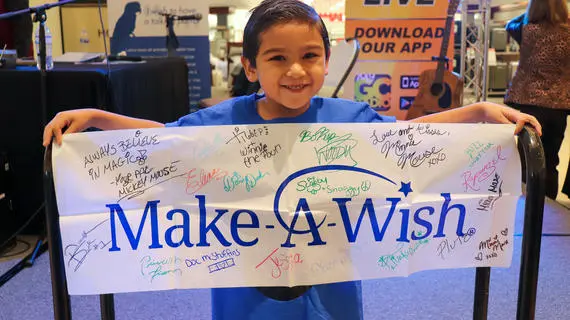

Make-A-Wish Foundation Donation: How Your Contribution Makes a Dream Come True