How to Start a Bookkeeping Business in 2025: A Step-by-Step Guide

Starting a bookkeeping business in 2025 can be an excellent entrepreneurial opportunity. With the rise of digital tools and the increasing demand for accurate financial management, many small businesses are seeking professional help to manage their finances. If you're thinking about entering the bookkeeping field, it's important to understand the basics of setting up your business, the skills required, and how to attract clients. In this guide, we will walk you through the essential steps to starting a bookkeeping business, including the key services you should offer, and tips on how to grow and scale your practice effectively.

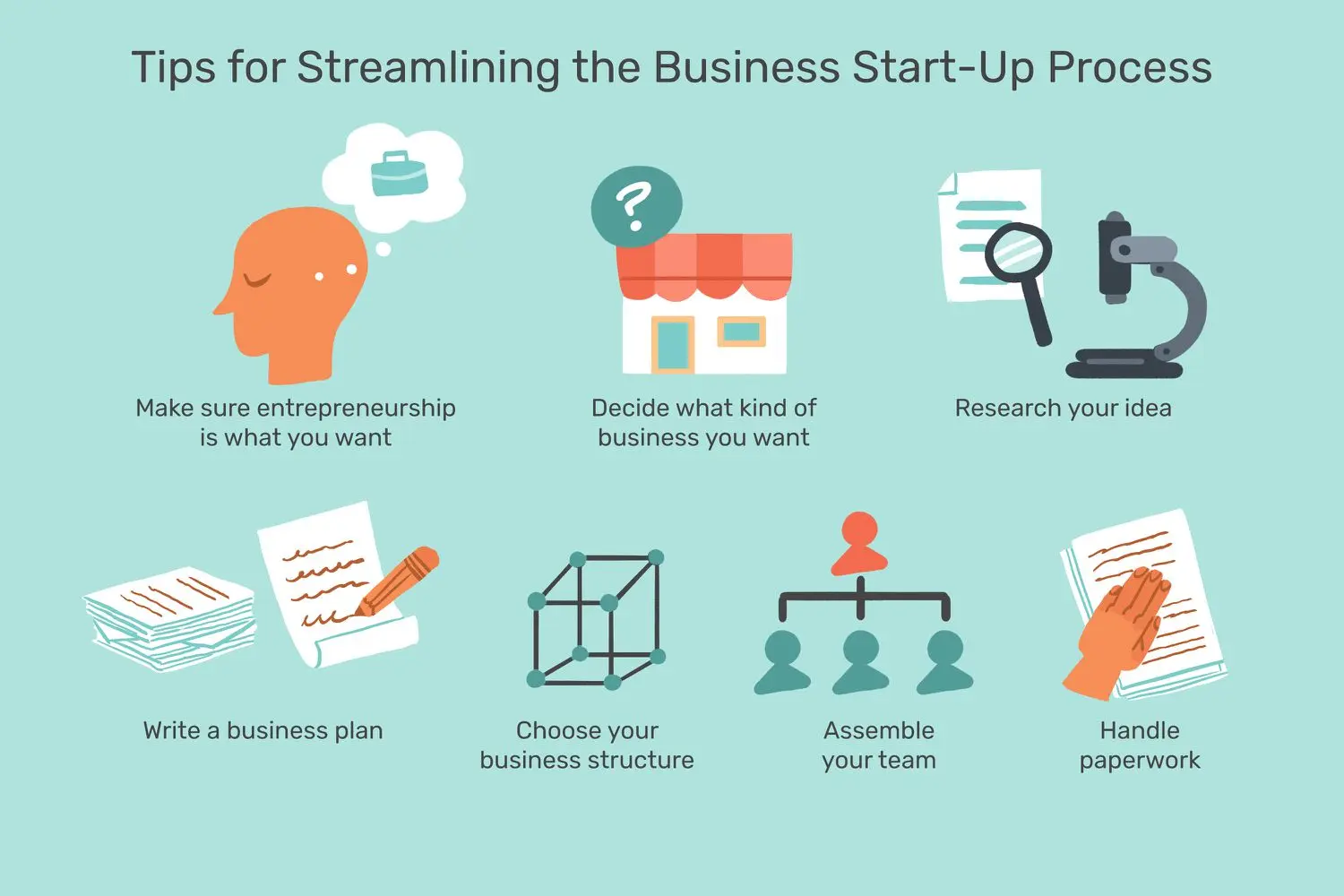

Steps to Starting Your Bookkeeping Business

1. Gain Necessary Skills and Certifications

Before starting a bookkeeping business, it's crucial to have the right skills and qualifications. Although some people may start their business with limited experience, obtaining certifications will enhance your credibility and increase your chances of attracting clients. Consider the following steps:

- Basic Bookkeeping Knowledge: Make sure you understand financial statements, accounts payable and receivable, payroll, and taxes.

- Get Certified: Certifications like the Certified Bookkeeper (CB) designation or QuickBooks Certification are valuable and can provide you with a competitive edge.

- Stay Updated: Bookkeeping practices change with tax laws and financial software, so staying updated on new trends and regulations is essential.

2. Create a Business Plan

Creating a solid business plan is a crucial step when starting a bookkeeping business. A well-thought-out plan will help you define your goals, target market, services offered, and pricing structure. Key components to include in your business plan are:

| Component | Description |

|---|---|

| Services Offered | Decide on the specific services you will provide, such as tax preparation, payroll, or financial analysis. |

| Target Market | Identify your target clients (small businesses, freelancers, or large companies) and tailor your services to their needs. |

| Pricing Structure | Determine how you will charge for services, whether hourly, monthly retainer, or per-project pricing. |

| Marketing Strategy | Develop strategies for attracting clients, including digital marketing, networking, and referrals. |

| Financial Plan | Include projections for startup costs, ongoing expenses, and revenue expectations. |

3. Set Up Your Legal Structure

You need to choose a legal structure for your business. Most bookkeeping businesses operate as:

- Sole Proprietorship: The simplest option for individuals starting a business on their own.

- LLC (Limited Liability Company): Offers personal liability protection, making it a good choice for small business owners.

- Corporation: A more complex structure typically used for larger businesses or those planning to expand rapidly.

Consult with a legal professional to choose the best structure for your specific situation.

4. Register Your Business and Get Necessary Licenses

Once you have decided on your business structure, you will need to register your business with the local authorities. Additionally, depending on your location, you may need various licenses or permits to operate legally. Common requirements include:

- Business License: Required by most cities or states to operate a business legally.

- EIN (Employer Identification Number): If you plan to hire employees, you’ll need to obtain an EIN from the IRS.

- Specialized Certifications: Certain areas of bookkeeping, such as tax preparation, might require additional licenses or certifications.

5. Choose the Right Bookkeeping Software

The right bookkeeping software is essential for running an efficient business. Popular options include:

| Software | Features |

|---|---|

| QuickBooks | Widely used for small businesses, offering comprehensive features such as invoicing, payroll, and reporting. |

| Xero | Cloud-based software known for its ease of use, especially for managing multiple clients. |

| FreshBooks | Ideal for freelancers or small business owners, with invoicing and time tracking features. |

| Wave | Free bookkeeping software that’s suitable for small businesses and startups. |

Using the right software can save time, reduce errors, and improve client satisfaction.

6. Market Your Bookkeeping Business

Marketing your bookkeeping business is crucial to attracting clients. Focus on both online and offline strategies to build a strong client base:

- Digital Marketing: Create a professional website, use social media platforms like LinkedIn, and consider investing in SEO to drive traffic to your site.

- Networking: Attend local business events or join online groups for small business owners to build connections and establish a reputation.

- Referral Programs: Encourage satisfied clients to refer you to others by offering incentives, such as discounts on services.

7. Grow and Scale Your Business

As your bookkeeping business grows, consider scaling by hiring additional staff or offering more services such as tax planning, financial analysis, or consulting. Use your accounting software to automate routine tasks, allowing you to focus on more valuable activities like client acquisition and business development.

Conclusion: Why Starting a Bookkeeping Business in 2025 Is a Smart Move

Starting a bookkeeping business in 2025 offers significant opportunities for growth, especially as small businesses and freelancers continue to thrive. By gaining the necessary qualifications, creating a solid business plan, and effectively marketing your services, you can establish a successful business that helps others manage their finances. Whether you're interested in operating as a solo entrepreneur or scaling to a full-fledged company, the demand for reliable and professional bookkeeping services will continue to grow.

Explore

How to Start a Business: A Step-by-Step Guide

How to Set Up Online Banking for Your Small Business: A Step-by-Step Guide

How to Apply for a Small Business Loan Online: A Step-by-Step Guide

How to Book a Private Jet Charter: A Step-by-Step Guide

Best Bookkeeping Services for Small Business

Small Business Digital Phone Systems: A Complete Guide

The Ultimate Guide to Choosing Online Banking for Your Small Business

Secure Your Business: Exploring the Best Cloud Backup Services