How to Set Up Online Banking for Your Small Business: A Step-by-Step Guide

Setting up online banking for your small business is an essential step toward streamlining your financial operations, saving time, and reducing banking fees. With the rise of online banking services in 2025, it's easier than ever for small business owners to access secure, efficient, and low-fee banking solutions. Whether you're a freelancer, a startup, or a growing company, this step-by-step guide will help you get started with online banking, enabling you to manage your finances with ease.

Why Choose Online Banking for Your Small Business?

Before diving into the setup process, it’s important to understand why online banking is a popular choice for small businesses. Here are some of the main benefits:

- Lower Fees: Online banks generally offer lower fees compared to traditional banks, which is especially advantageous for small business owners looking to cut costs.

- Convenience: Access your account from anywhere, at any time, using mobile apps or desktop banking platforms.

- Faster Transactions: Most online banks provide quicker ACH transfers, wire transfers, and bill payments, helping businesses manage their cash flow efficiently.

- Advanced Features: Features such as mobile check deposits, expense tracking, and integration with accounting software are widely available in online banking services.

Now that you know why online banking is ideal for your business, let’s walk through the steps for setting up your online business banking.

Step 1: Choose the Right Online Bank for Your Business

The first step in setting up online banking is choosing the right bank. Factors to consider include fees, features, customer support, and cash deposit options. Below is a comparison table of some of the top online banks for small businesses in 2025:

| Bank Name | Monthly Fee | Key Features | Best For | Cash Deposit Options |

|---|---|---|---|---|

| BlueVine | $0 | Unlimited transactions, 1.00% interest on balances up to $250,000 | Businesses with high transaction volume | ATMs via a network |

| Novo | $0 | No fees, integrates with over 50 business tools, free ACH transfers | Tech-savvy entrepreneurs | Stripe and partner deposits |

| Lili | $0 (Free Plan) | Business expense categorization, tax savings tools | Freelancers and independent contractors | MoneyPak for cash deposits |

| Axos Bank | $0-$10 | High-volume transactions, free ACH transfers | High-transaction businesses | ATMs and partner locations |

| Kabbage | $0 | No fees, flexible credit lines | Businesses needing working capital | ATMs via network |

| Chase Business Complete Banking | $15 (free for first 60 days) | Access to over 16,000 ATMs, integrated payment systems | Established small businesses | Chase ATMs & partner locations |

Once you’ve selected the right bank, you’ll be ready to move forward with the setup process.

Step 2: Gather Your Business Information

To set up your online business banking account, you’ll need to gather some important documents and information. Here's what you’ll typically need:

- Business name and address

- Employer Identification Number (EIN) or Social Security Number (SSN) if you’re a sole proprietor

- Business license or any government-issued identification

- Legal structure of your business (LLC, S Corp, etc.)

- Personal identification, such as a passport or driver’s license, for the account holder

Having all this information ready will speed up the process and ensure that your application is processed smoothly.

Step 3: Sign Up and Fill Out the Application

Once you’ve gathered all the required information, visit the bank’s website and fill out the online application. You’ll typically be asked to provide:

- Your business name, contact information, and EIN

- Your legal business structure (LLC, Sole Proprietorship, etc.)

- Personal information for the primary account holder (you or a designated person)

- Business details such as revenue and estimated monthly transactions

Make sure to double-check everything before submitting to avoid delays.

Step 4: Verify Your Identity and Business

After you’ve submitted your application, most online banks will need to verify your identity and business. The verification process can vary by bank but typically involves:

- Personal identification verification (driver’s license, passport, etc.)

- Business verification (EIN, tax documents, business license)

- Social Security Number (SSN) or Tax ID for the business owner

Some banks may require a video call or the submission of additional documents for further verification.

Step 5: Fund Your Account and Set Up Online Banking

Once your online business account is approved and verified, you can fund your account. You can usually do this by:

- Transferring funds from another bank

- Depositing checks via mobile deposit

- Depositing cash at ATMs or through partner locations (depending on the bank)

After funding your account, you can set up online banking by downloading the bank’s mobile app or accessing the online banking portal via desktop. This will allow you to:

- Track transactions

- Send and receive payments

- Set up recurring payments

- View account balances and financial reports

Step 6: Link Your Accounting Software and Business Tools

Many online banks allow you to link your account directly with accounting software like QuickBooks, Xero, or Wave. This integration helps you automate many tasks, including:

- Expense tracking

- Tax calculations

- Generating financial reports

This can save you significant time during tax season and provide a clearer picture of your financial situation.

Step 7: Start Managing Your Business Finances

Now that your account is set up, you can start managing your finances with ease. Here are some tips for efficient financial management:

- Monitor your account regularly to avoid fraud and ensure everything is running smoothly.

- Set up automated bill payments to avoid late fees.

- Use your business debit card for purchases and track them in your accounting software.

- Review monthly statements to ensure your business is on track financially.

Conclusion: Why Online Banking is the Best Choice for Your Small Business

Setting up online banking for your small business is a straightforward process that can save you both time and money. By choosing the right bank, gathering your business information, and following the necessary steps, you’ll have your online banking account up and running in no time.

The benefits of online banking include:

- Lower fees

- 24/7 access

- Seamless integrations with business tools

- Faster transactions

Whether you're a freelancer, a growing startup, or a more established small business, online banking offers the tools and flexibility you need to manage your finances effectively.

Explore

Best Online Banks for Small Business Owners: Comparing Fees and Services

The Ultimate Guide to Choosing Online Banking for Your Small Business

How to Apply for a Small Business Loan Online: A Step-by-Step Guide

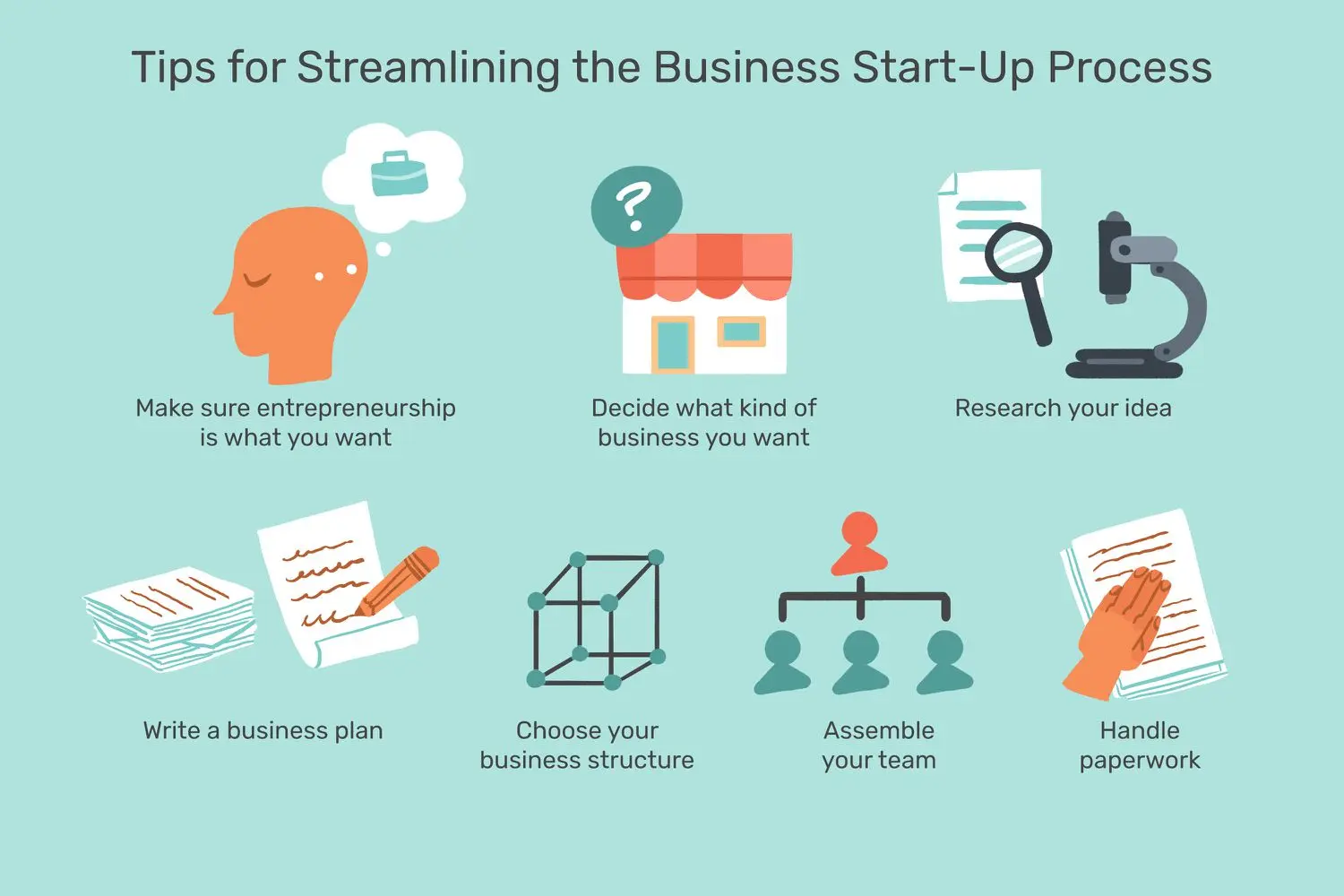

How to Start a Business: A Step-by-Step Guide

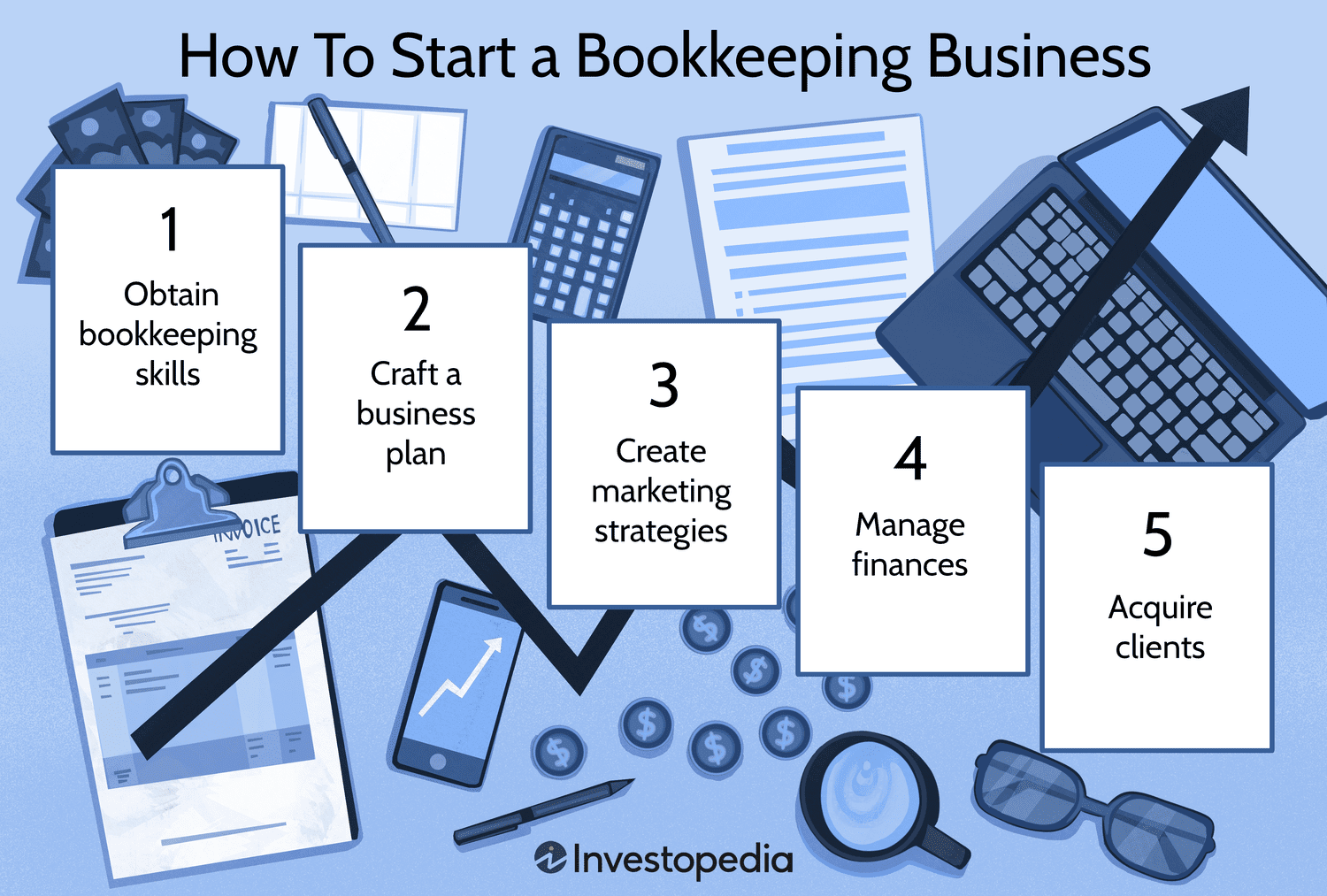

How to Start a Bookkeeping Business in 2025: A Step-by-Step Guide

How to Book a Private Jet Charter: A Step-by-Step Guide

How to Apply for a Low Interest Small Business Loan Online

Small Business Digital Phone Systems: A Complete Guide