How to Choose the Best Joint Savings Account: A 2025 U.S. Guide

Whether you're planning a wedding, managing household expenses, or saving for a big purchase, opening a joint savings account can be a smart move. Designed for two or more individuals to co-manage funds, these accounts offer convenience, shared goals, and transparency. In this guide, we’ll walk you through what to consider when choosing the best joint savings account in 2025 and compare some of the top options available for U.S. consumers.

What Is a Joint Savings Account?

A joint savings account is a bank account owned by two or more individuals, typically partners, spouses, or family members. All account holders have equal access and rights to deposit, withdraw, and manage the funds. Joint accounts can help streamline shared budgeting, encourage mutual saving habits, and provide a centralized place to manage money.

Pros and Cons of Joint Savings Accounts

| Pros | Cons |

|---|---|

| Easier to save for shared goals | Both parties can withdraw funds at any time |

| Simplified budgeting and tracking | Potential for financial disputes |

| Equal access and transparency | May affect credit score if overdrafts occur |

| Often higher interest than checking | Tax implications if interest income is high |

Top Joint Savings Accounts in 2025

Here’s a comparison of some of the best joint savings accounts for U.S. consumers in 2025:

| Bank/Institution | APY (Annual %) | Minimum Balance | Monthly Fees | Features |

|---|---|---|---|---|

| Ally Bank | 4.25% | $0 | $0 | High yield, mobile app, no fees |

| Capital One 360 | 4.15% | $0 | $0 | User-friendly, shared goals tracking |

| Discover Online | 4.20% | $0 | $0 | 24/7 support, FDIC insured |

| SoFi Joint Savings | 4.50% | $0 | $0 | Bonus for direct deposit, mobile tools |

| Chase Savings (Joint) | 0.01% | $300 | Up to $5 | Branch access, Zelle integration |

| Marcus by Goldman Sachs | 4.40% | $0 | $0 | High yield, easy transfers |

| Synchrony Bank | 4.35% | $0 | $0 | ATM access, high-yield interest |

What to Look for in a Joint Savings Account

When choosing a joint savings account in 2025, consider the following key factors:

- APY (Annual Percentage Yield): Higher APY means your savings earn more interest over time. Online banks tend to offer better rates than traditional banks.

- Fees: Look for accounts with no monthly maintenance or minimum balance fees. These costs can eat into your savings over time.

- Accessibility: Make sure both account holders can easily access and manage the account via mobile apps or online banking.

- FDIC Insurance: Ensure the bank is FDIC-insured to protect your funds up to $250,000 per depositor.

- Joint Management Features: Some accounts offer features like savings goals, spending trackers, or shared notifications to help with joint budgeting.

Who Should Open a Joint Savings Account?

Joint savings accounts are ideal for:

- Couples managing joint expenses or saving for a wedding, home, or vacation.

- Roommates or friends pooling money for rent or travel.

- Parents and children managing shared expenses or teaching financial literacy.

- Family members saving for a common purpose like emergencies or caregiving costs.

If there’s mutual trust and shared financial goals, a joint account can simplify money management and build stronger accountability.

Final Thoughts

Choosing the best joint savings account in 2025 comes down to understanding your needs, comparing interest rates and fees, and finding a bank that makes shared money management simple. With the right account, you and your co-saver can build a stronger financial future—together.

Explore

Reap the Rewards: Open a Savings Account Online Today

Best High-Yield Savings Accounts for 2025: Maximize Your Savings Potential

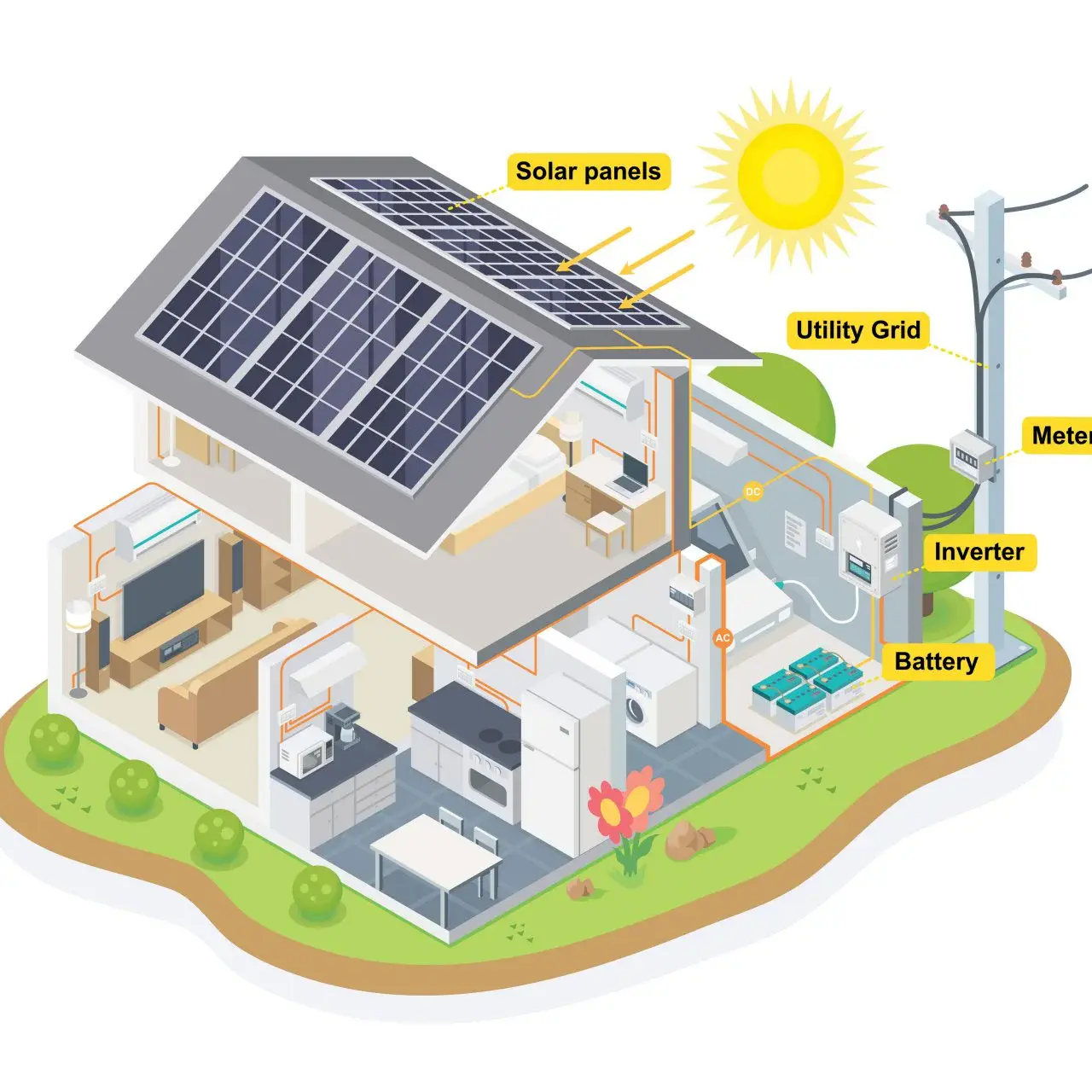

How to Choose the Best Home Solar System for Your Needs: A Complete Guide

The Ultimate Guide to Custom Boxes: How to Choose the Perfect Packaging for Your Products

How to Choose the Best Digestive Health Supplement: A Beginner's Guide

How to Choose the Right Hair Growth Serum for Your Hair Type and Needs

How to Choose the Best Personal Injury Lawyer for Your Case

How to Choose the Right ERP System for Small Businesses