Understanding Cancer Insurance: Why It's Essential for Your Health Coverage

Cancer insurance is an important aspect of health coverage, specifically designed to provide financial support when cancer treatment becomes necessary. Cancer insurance offers specialized coverage that addresses the high costs of cancer care, which may not be fully covered by standard health insurance. This article explores the benefits of cancer insurance, how it works, and why it's essential to ensure comprehensive health protection for those at risk.

What Is Cancer Insurance?

Cancer insurance is a supplemental health policy that helps cover the costs associated with cancer treatment, including chemotherapy, radiation, surgery, and more. While standard health insurance may cover many medical expenses, cancer treatment can still lead to substantial out-of-pocket costs. Cancer insurance provides an additional layer of financial protection, specifically tailored to the unique costs of cancer care.

Key Features of Cancer Insurance:

- Cash Benefits: Lump sum payouts that can be used for treatment or other expenses.

- Specialized Coverage: Focuses on cancer-specific care, such as chemotherapy and radiation.

- No Restrictions: Patients can use the benefits for a variety of needs, from medical bills to living expenses.

Why Cancer Insurance Is Essential

Cancer is one of the most common and costly diseases to treat, and the financial burden of treatment can be overwhelming. Cancer insurance provides critical financial assistance, helping patients manage the high costs of care without depleting their savings. Even those with regular health insurance may find that their plans do not cover all cancer-related expenses.

Benefits of Cancer Insurance:

- Financial Security: Helps cover high out-of-pocket expenses for cancer treatments not covered by regular insurance.

- Faster Access to Treatment: With cancer insurance, patients can access treatments more quickly, as they are not limited by cost concerns.

- Peace of Mind: Knowing that cancer-related expenses are covered reduces anxiety for both patients and their families.

How Cancer Insurance Works

Cancer insurance policies vary, but they generally provide benefits in the form of cash payments, which can be used at the policyholder's discretion. These benefits can help with direct medical costs or indirect costs such as transportation, lodging, and household expenses while undergoing treatment.

| Type of Coverage | What It Covers | Common Benefits |

|---|---|---|

| Diagnosis Benefits | Payout upon cancer diagnosis | Lump sum payment upon confirmed cancer diagnosis. |

| Treatment Benefits | Covers treatment costs like chemotherapy and surgery | Pays for medical treatment, including hospitalization, chemotherapy, and radiation. |

| Post-Treatment Benefits | Recovery and rehabilitation | Covers post-treatment costs such as follow-up care and rehabilitation. |

| Living Expenses | Non-medical costs | Helps cover daily living costs like transportation, lodging, and meals. |

Factors to Consider When Choosing Cancer Insurance

When selecting cancer insurance, it’s important to consider several key factors to ensure you get the best coverage for your needs.

Key Considerations:

- Policy Limits: Understand the maximum payout limits and how they apply to different types of treatment.

- Exclusions: Ensure you know what is not covered by the policy, such as certain experimental treatments or pre-existing conditions.

- Premiums: Assess whether the premiums fit within your budget, considering your overall health and risk factors.

- Coverage Scope: Ensure the policy covers both early-stage and advanced cancer treatments, including surgery, chemotherapy, and palliative care.

Conclusion: Why Cancer Insurance Is a Wise Investment

Investing in cancer insurance is a proactive way to protect yourself and your family from the high costs of cancer treatment. With the rising costs of medical care and the unpredictable nature of cancer, having a specialized insurance policy in place can offer invaluable peace of mind and financial security. By understanding the benefits, coverage options, and key factors involved in selecting a plan, you can ensure that you are well-prepared to handle the challenges of cancer care should the need arise.

Explore

Understanding Uterus Cancer Treatment: What’s New in 2025?

Mental Health and Cancer Care: The Importance of Emotional Support During Treatment

Cancer Treatment Breakthroughs: What’s on the Horizon in 2025?

New Breakthroughs in Advanced Prostate Cancer Treatment

Best Treatment Options for Lung Cancer in 2025

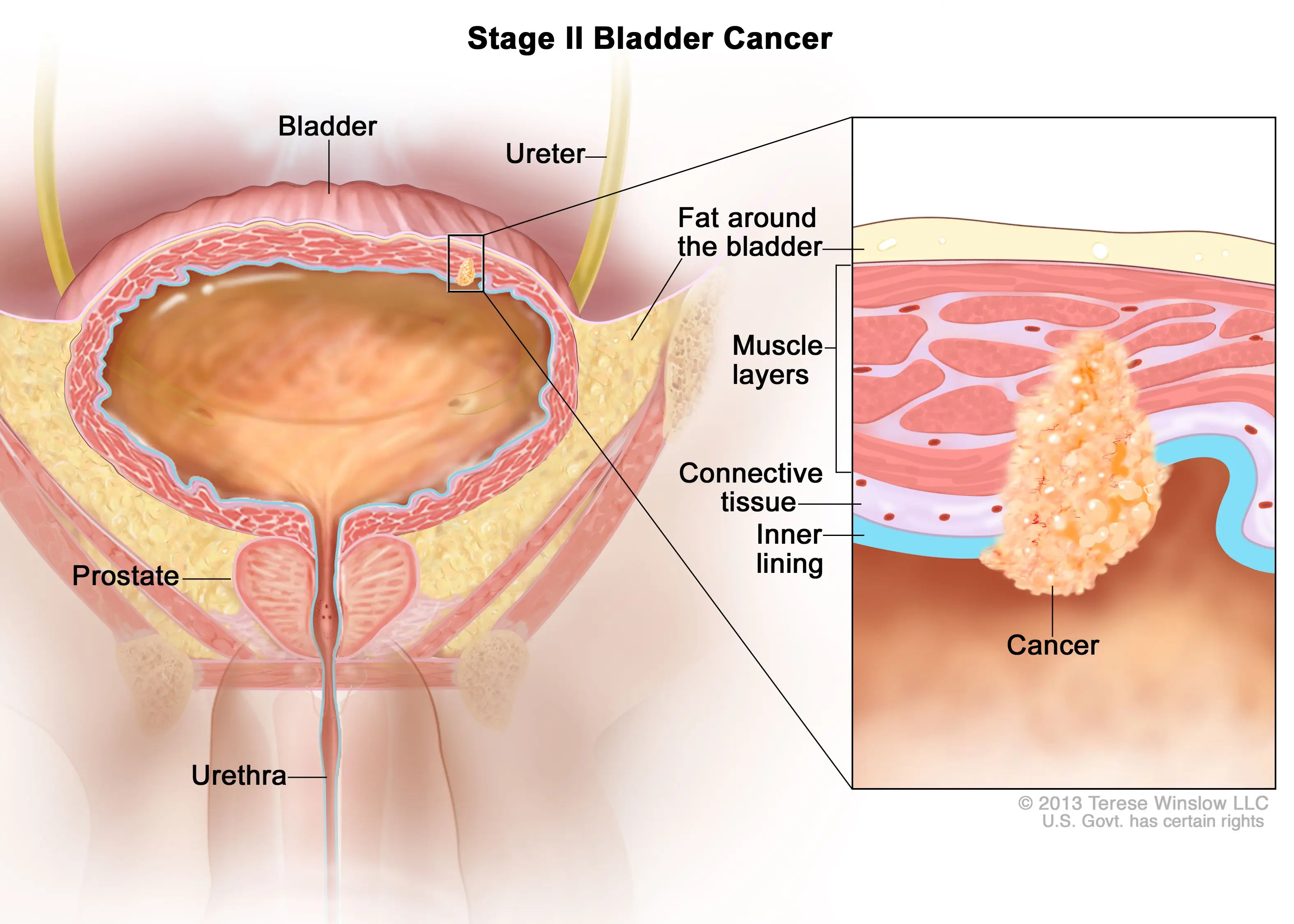

Top Bladder Cancer Treatment Options You Should Know About

What Are the Most Effective Pancreatic Cancer Treatments in 2025?

The Ultimate Guide to Cancer Screening: Early Detection Saves Lives