Top Cash Back Credit Cards for Your Business

In 2025, maximizing business expenses through cash back credit cards can significantly enhance your company’s financial health. Here are the top cash back credit cards designed to offer excellent rewards, benefits:

1. Chase Ink Business Cash® Credit Card

The Chase Ink Business Cash® Credit Card is a top choice for small businesses. It offers 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable, and phone services each account anniversary year. Additionally, it provides 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants, and 1% on all other purchases.

2. American Express Blue Business Cash™ Card

This card offers a straightforward 2% cash back on all eligible purchases up to $50,000 per calendar year, then 1%. It’s ideal for businesses with varied spending needs. The card also provides flexible payment options and the benefit of carrying a balance with no annual fee.

3. Capital One Spark Cash for Business

Capital One Spark Cash for Business offers an unlimited 2% cash back on every purchase, making it a great option for businesses with diverse spending categories. The card comes with a $0 introductory annual fee for the first year, then $95 thereafter, which can easily be offset by the cash back rewards.

4. Bank of America® Business Advantage Customized Cash Rewards Mastercard®

This card allows businesses to earn 3% cash back in a category of their choice, including gas stations, office supply stores, travel, TV/telecom and wireless, computer services, or business consulting services. It also offers 2% cash back on dining and unlimited 1% on all other purchases. The 3% and 2% cash back apply to the first $50,000 in combined choice category/dining purchases each calendar year.

5. U.S. Bank Business Cash Rewards World Elite™ Mastercard®

The U.S. Bank Business Cash Rewards World Elite™ Mastercard® provides 3% cash back on eligible gas station, office supply store, and cell phone/service provider purchases. It also offers 1% cash back on all other eligible net purchases. Additionally, cardholders get a 25% annual bonus based on the previous year’s cash rewards, up to $250.

6. CitiBusiness® / AAdvantage® Platinum Select® Mastercard®

While primarily an airline card, it offers 2% cash back on eligible American Airlines purchases, telecommunications merchants, cable and satellite providers, car rental merchants, and at gas stations. Plus, it provides 1% on other purchases, making it a versatile option for businesses with travel needs.

7. Discover it® Business Card

The Discover it® Business Card offers unlimited 1.5% cash back on every purchase. As a unique feature, Discover matches all the cash back you’ve earned at the end of your first year, effectively doubling your rewards. There’s no annual fee, and you also get access to free business credit score monitoring.

8. Sam’s Club® Business Mastercard®

This card offers 5% cash back on gas purchases (up to $6,000 per year), 3% cash back on dining, and 1% cash back on other purchases. It’s a solid choice for businesses that frequently spend on fuel and dining.

9. Amazon Business Prime American Express Card

For businesses that make frequent purchases on Amazon, this card offers 5% cash back on U.S. purchases at Amazon Business, AWS, Amazon.com, and Whole Foods Market (on the first $120,000 spent per year, then 1%). It also provides 2% cash back at U.S. restaurants, gas stations, and on wireless telephone services, and 1% on other purchases.

10. PNC Cash Rewards® Visa Signature® Business Credit Card

This card offers 1.5% cash back on net purchases with no limits on the amount you can earn. It’s straightforward and beneficial for businesses looking for a consistent cash back rate without category restrictions.

By choosing the right cash back credit card, your business can save significantly on everyday expenses, enhance cash flow, and invest more in growth opportunities in 2025.

Explore

Cash in Hand: Your Quick Guide to Selling Your House Fast

Secure Your Business: Exploring the Best Cloud Backup Services

Transform Your Business with IT Cloud Solutions: Benefits, Challenges, and Best Practices

Managed Security Services: Protecting Your Business from Cyber Threats

Best Bookkeeping Services for Small Business

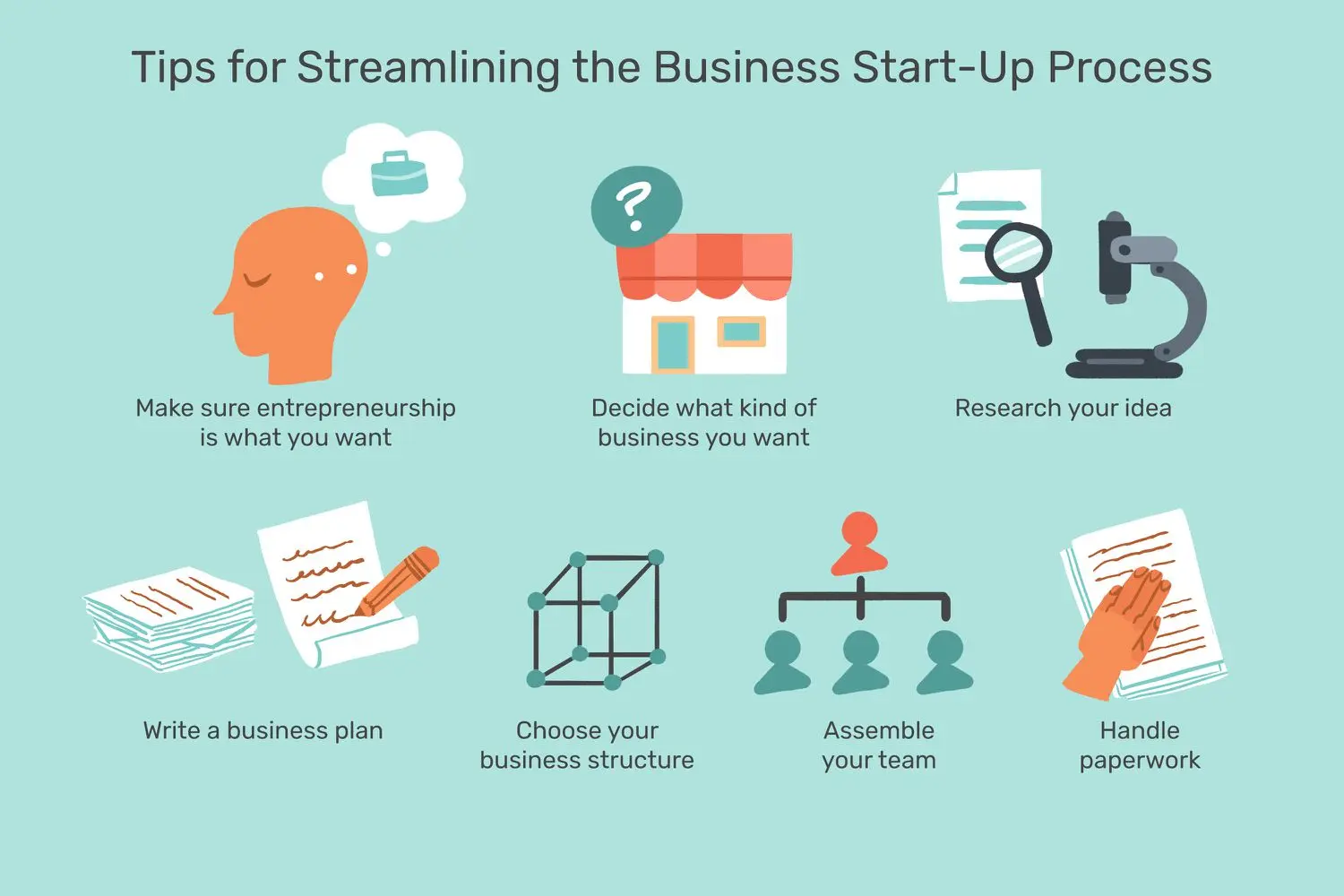

How to Start a Business: A Step-by-Step Guide

AI Tools for Small Business Growth: Transforming Efficiency and Productivity

Oracle NetSuite Cloud: Revolutionizing Business Management with Cloud ERP