The Rise of Sustainable Investment: Why It’s the Future of Finance

Sustainable investment is no longer a niche strategy—it's becoming a dominant force in the financial world. As global awareness of environmental, social, and governance (ESG) issues grows, investors are increasingly prioritizing sustainability alongside financial returns. This shift towards green investments, impact investing, and ESG-focused funds signals a significant transformation in the way finance works. In this article, we’ll explore why sustainable investment is the future of finance and how it’s reshaping the investment landscape.

What Is Sustainable Investment?

Sustainable investment refers to the practice of making investment decisions based on both financial returns and non-financial factors, including environmental, social, and governance criteria. Investors are now looking beyond profits to consider the broader impact of their investments, whether it’s on climate change, social equity, or corporate governance practices.

| Investment Type | Description | Key Benefit |

|---|---|---|

| ESG Investing | Focuses on companies with strong environmental, social, and governance practices | Aligns profits with values |

| Impact Investing | Targets investments that generate measurable social or environmental impact | Creates positive change while earning returns |

| Green Bonds | Bonds issued to fund environmentally sustainable projects | Contributes to the fight against climate change |

Why Is Sustainable Investment Growing?

There are several reasons why sustainable investing is gaining traction, including:

1. Increasing Demand for Ethical Investments

Investors, especially younger generations, are increasingly prioritizing investments that align with their values. Millennials and Gen Z are driving a shift towards responsible investing, seeking to make a positive impact on society and the planet through their financial choices.

2. Regulatory and Policy Changes

Governments around the world are beginning to mandate greater disclosure of ESG data by companies. This is increasing the transparency of investments and encouraging financial institutions to integrate sustainability into their investment strategies. The EU Green Deal and U.S. Sustainable Finance Disclosure Regulation are examples of how regulation is shaping the future of sustainable finance.

3. Financial Performance

Many studies have shown that companies with strong ESG practices tend to outperform their peers in the long term. Sustainable companies are often more resilient to market shocks, less risky, and better equipped to navigate future challenges, such as climate change and social inequality.

Key Trends in Sustainable Investment

As sustainable investment continues to rise, several key trends are shaping its future:

1. ESG Integration Across All Asset Classes

While ESG investing started in niche sectors, it’s now becoming a mainstream practice across all asset classes, including stocks, bonds, real estate, and even private equity. Financial institutions are developing more sophisticated models to assess ESG factors, making it easier for investors to make informed decisions.

2. Rise of Impact Funds and Green Bonds

Impact funds are gaining popularity among investors who want to see measurable social or environmental returns in addition to financial ones. Green bonds, used to fund environmentally sustainable projects, are also seeing a surge in interest as the demand for green infrastructure and clean energy increases.

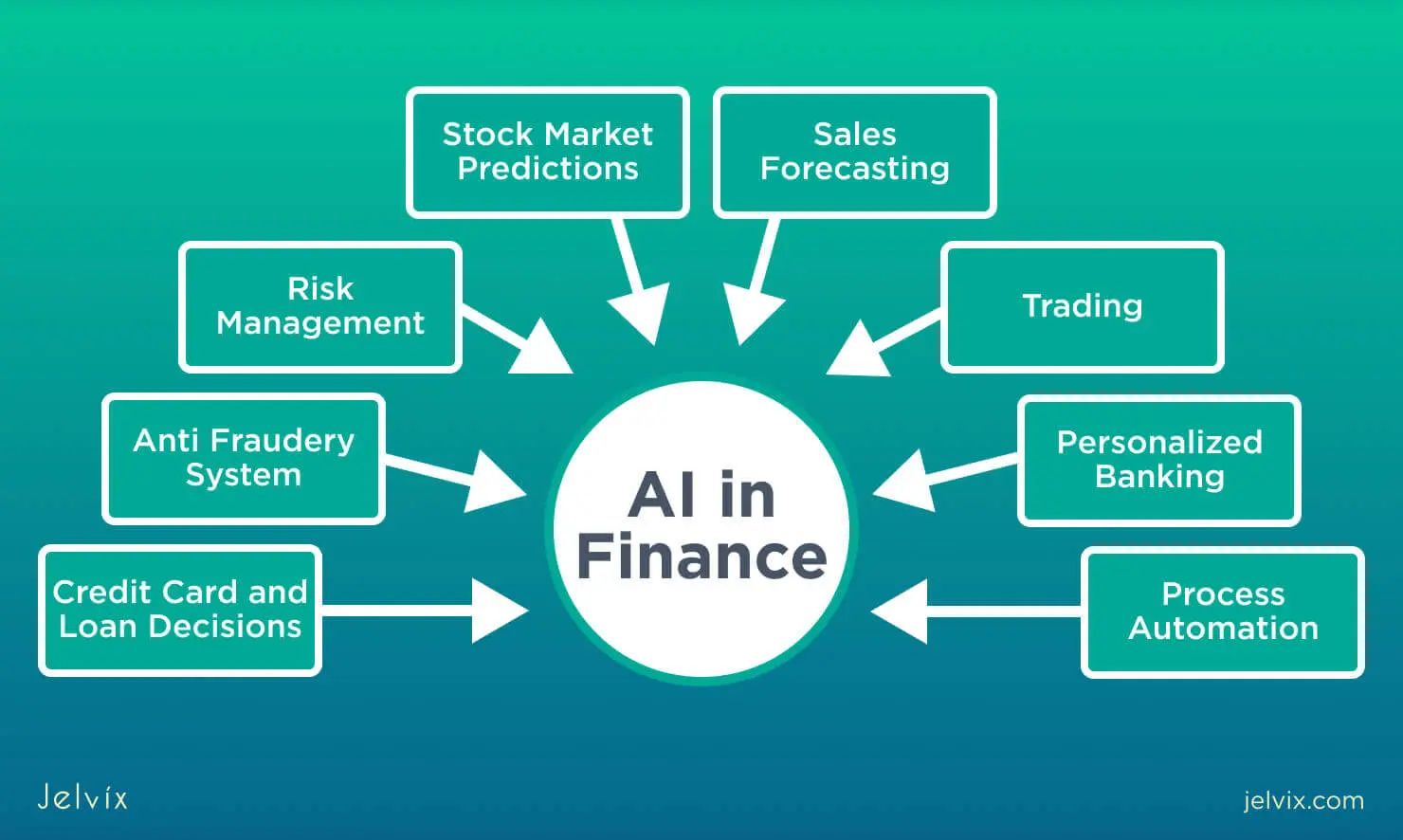

3. Technological Innovation in ESG Investing

Technology is playing a major role in advancing sustainable finance. AI-driven platforms and big data are being used to assess ESG risks and opportunities, enabling more precise and effective sustainable investment strategies.

The Future of Sustainable Investment

The future of finance will be increasingly driven by sustainability. In the next decade, we expect to see further innovations in sustainable investing, including more automated ESG scoring systems, greater regulatory alignment, and the expansion of green financial products.

| Future Trend | Description | Potential Impact |

|---|---|---|

| AI-Powered ESG Analysis | AI tools that evaluate ESG factors in real-time | Enhances accuracy and efficiency in investment decisions |

| Global ESG Standards | A unified global standard for ESG reporting | Increases transparency and comparability across markets |

| Sustainable Infrastructure Investment | Investment in renewable energy, clean tech, and eco-friendly infrastructure | Drives the transition to a low-carbon economy |

Conclusion

Sustainable investment is set to be the future of finance, driven by growing demand for ethical investment strategies, stronger regulatory frameworks, and a shift towards investments that generate both financial returns and positive societal impact. As we move forward, we can expect further innovation in ESG practices and greater integration of sustainability into mainstream investment strategies. Whether you're an individual investor or a large institution, embracing sustainable investment is no longer just a choice—it’s an essential part of a forward-thinking financial strategy.

Explore

The Future of Alternative Energy: Key Trends in Clean and Sustainable Power

The Importance of Environmental Impact Assessment in Sustainable Development

Eco-Friendly Home Renovation: Sustainable Ideas for Modern Living

Breast Enlargement Finance: Affordable Options for Your Aesthetic Goals

AI in Finance: Revolutionizing the Financial Industry

Rednote's(XiaoHongShu) Rise Amidst TikTok Ban: How to Become a High-Traffic Blogger on Rednote

Top 10 Socially Responsible Investment Strategies for 2025

How Does Real Estate Crowdfunding Work? Exploring the Investment Process