The Impact of AI in Insurance: Revolutionizing the Industry

The integration of AI in insurance is reshaping the industry, enhancing efficiency, and delivering personalized customer experiences. From claims processing to underwriting, artificial intelligence is driving innovations that were once considered unattainable. This article delves into the key areas where AI is transforming insurance and highlights its advantages with data-driven insights.

Key Applications of AI in Insurance

1. Automated Claims Processing

AI-powered systems can analyze claims quickly and accurately, significantly reducing processing times. Machine learning algorithms can detect fraud, ensuring only legitimate claims are approved. For example, some insurers use AI to:

- Assess damages from photos submitted by policyholders.

- Validate claims using historical data.

2. Personalized Policy Recommendations

By leveraging AI, insurers can analyze customer data to offer tailored insurance products. This personalization improves customer satisfaction and increases policy uptake. Key methods include:

- Utilizing predictive analytics to identify customer needs.

- Offering dynamic pricing based on individual risk profiles.

3. Fraud Detection

Fraudulent claims cost the industry billions annually. AI systems can identify patterns of fraud through data analysis, reducing financial losses. Techniques include:

- Real-time monitoring of transactions.

- Cross-referencing claims data with external databases.

4. Improved Underwriting

AI enhances underwriting accuracy by analyzing extensive datasets, including social media and IoT device data. This allows insurers to assess risk more comprehensively and set appropriate premiums.

Benefits of AI in Insurance

| Benefit | Description |

|---|---|

| Increased Efficiency | Automating repetitive tasks allows employees to focus on complex issues. |

| Cost Reduction | Streamlined processes and fraud detection reduce operational expenses. |

| Enhanced Customer Service | AI chatbots provide 24/7 assistance, resolving queries faster. |

| Improved Risk Assessment | AI uses data analytics to accurately evaluate risks and set competitive premiums. |

Challenges to Overcome

While the advantages are clear, the adoption of AI in insurance comes with challenges:

- Data Privacy Concerns: Insurers must comply with regulations to protect customer data.

- High Implementation Costs: Developing and integrating AI systems can be expensive.

- Skill Gaps: Training staff to work with AI technologies requires significant investment.

The Future of AI in Insurance

As AI technology continues to advance, its role in the insurance industry will only grow. Emerging trends include:

- The use of blockchain to enhance data security.

- Expansion of AI-driven telematics for real-time monitoring.

- Greater emphasis on ethical AI practices to build trust.

By addressing current challenges and embracing innovation, insurers can fully leverage AI to deliver exceptional value to their customers.

Conclusion

The adoption of AI in insurance is not just a trend; it is a necessity for staying competitive in a rapidly evolving industry. From automating claims to enhancing customer service, AI is redefining what’s possible in insurance. Companies that invest in AI technologies today will lead the market tomorrow.

Explore

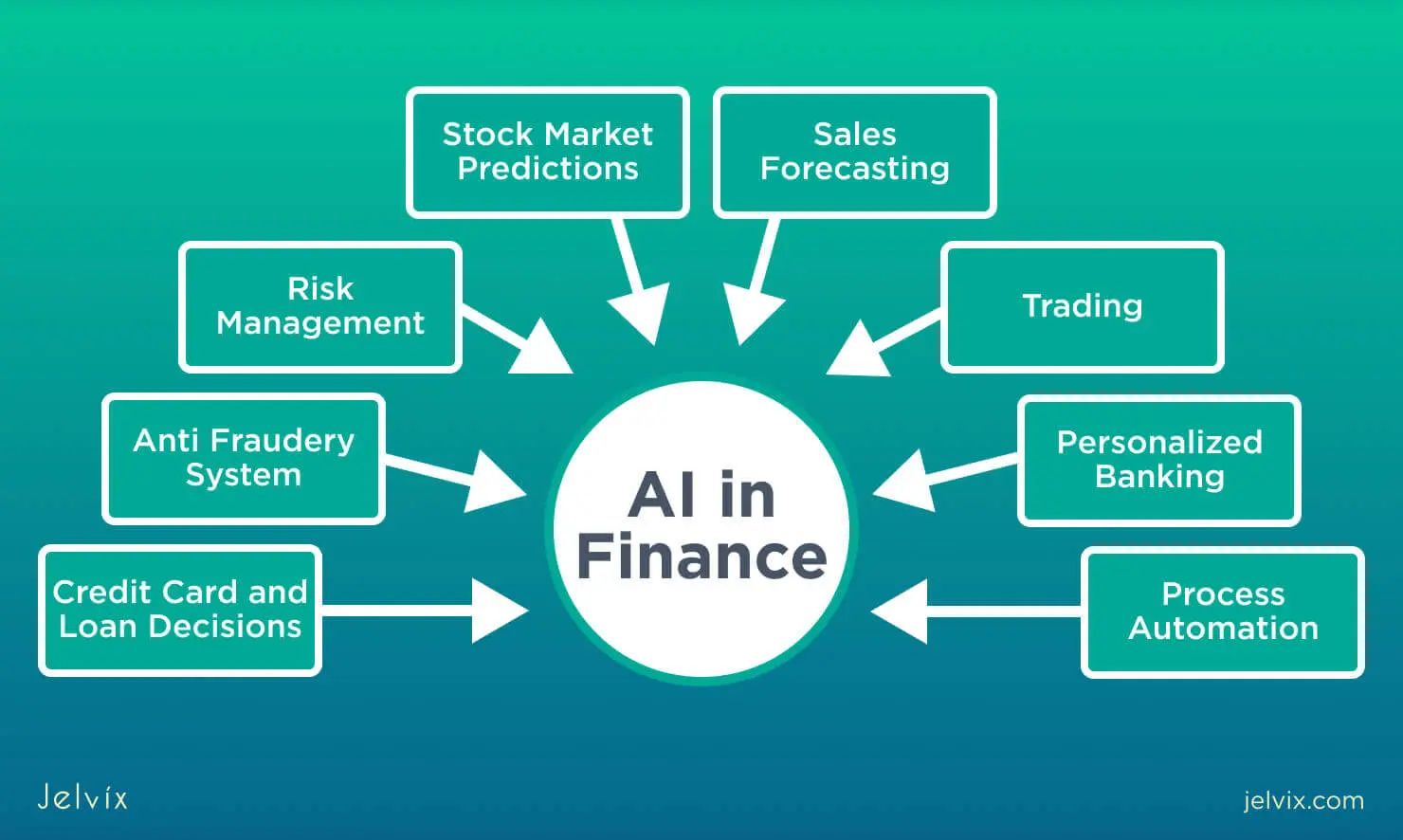

AI in Finance: Revolutionizing the Financial Industry

Oracle NetSuite Cloud: Revolutionizing Business Management with Cloud ERP

Save on Short-Term Fleet Needs: The Benefits of Temporary Commercial Vehicle Insurance

AI Car Insurance: The Future of Auto Coverage

Best Home Improvement Contractors Near Me

Find Best Local Roofers & Roofing Contractors Near Me

The Best 24-Hour Air Conditioning Repair Service Companies

Guide To Choosing The Right Payroll Services For Small Businesses