The Best Dental Insurance Plans for Individuals and Families in 2025

Choosing the right dental insurance plan for you and your family is essential for maintaining optimal oral health while managing costs. With so many options available in 2025, it’s important to consider factors such as coverage, affordability, and provider networks. In this article, we’ll explore the best dental insurance plans for individuals and families, highlighting key features and benefits to help you make an informed decision.

1. Key Factors to Consider When Choosing Dental Insurance

When selecting a dental insurance plan, there are several factors that should influence your decision:

| Factor | Details |

|---|---|

| Coverage | Look for comprehensive coverage that includes preventive care, basic services, and major procedures. |

| Premiums and Deductibles | Choose a plan that fits your budget, keeping both monthly premiums and deductibles in mind. |

| Network of Dentists | Ensure the plan has a large network of dentists or includes your current provider. |

| Waiting Periods | Check if the plan has waiting periods for major treatments, especially if you need immediate care. |

| Limitations and Exclusions | Read the fine print to understand what procedures and treatments are excluded. |

2. Top Dental Insurance Plans for Individuals in 2025

There are several dental insurance plans tailored for individual needs. Here are some of the best options available:

| Insurance Provider | Plan Type | Monthly Premium (Avg.) | Coverage | Key Benefits |

|---|---|---|---|---|

| Delta Dental | PPO, HMO, and Dental Savings | $20–$50 | Preventive, Basic, Major Procedures | Nationwide network, no waiting period for preventive care. |

| Cigna | PPO, Dental HMO | $15–$40 | Preventive, Basic, Major Procedures | High customer satisfaction, large provider network. |

| Humana | PPO, HMO | $18–$45 | Preventive, Basic, Major Procedures | Offers discounts on cosmetic services and orthodontics. |

| Guardian | PPO, HMO | $25–$55 | Preventive, Basic, Major Procedures | Access to a wide network, flexible coverage options. |

3. Top Dental Insurance Plans for Families in 2025

Families require dental plans that provide comprehensive coverage for all members, from preventive services to more advanced treatments. Below are some top-rated plans for families:

| Insurance Provider | Plan Type | Monthly Premium (Avg.) | Coverage | Key Benefits |

|---|---|---|---|---|

| Blue Cross Blue Shield | PPO, HMO | $60–$100 | Preventive, Basic, Major Procedures | Extensive family coverage, no waiting periods for basic services. |

| Aetna | PPO, Dental HMO | $40–$90 | Preventive, Basic, Major Procedures | Offers pediatric dental care, and orthodontic coverage for children. |

| MetLife | PPO, HMO | $50–$95 | Preventive, Basic, Major Procedures | Family discounts, choice of dentists within large network. |

| United Healthcare | PPO, HMO | $55–$110 | Preventive, Basic, Major Procedures | Offers coverage for kids’ dental braces and extensive family benefits. |

4. What Makes a Great Dental Insurance Plan?

While coverage and cost are important, there are other features that make dental insurance plans stand out:

| Feature | Importance |

|---|---|

| No Waiting Periods | Immediate coverage for preventive care can save time and money. |

| Orthodontic Coverage | Families with children may want a plan that covers braces or other orthodontic services. |

| Preventive Care | Plans that cover regular checkups, cleanings, and x-rays can help prevent more costly procedures later. |

| Flexible Plans | Choose a plan with options for add-ons or upgrades, such as vision or hearing coverage. |

5. How to Choose the Right Plan for Your Needs

Choosing the best dental insurance plan for yourself or your family depends on your specific needs and budget. Here are some steps to guide you:

- Assess Your NeedsConsider how often you visit the dentist and whether you need basic or major dental work (e.g., fillings, crowns, or root canals).

- Compare PlansEvaluate the monthly premiums, coverage, and the dentist network for each plan to ensure it fits your needs.

- Check for Additional CoverageSome plans offer additional benefits, like orthodontics, cosmetic dentistry, or vision care, which can be valuable for families.

- Review the NetworkMake sure that your preferred dentist is in the plan’s network, or that you are comfortable with the network of providers available.

6. Conclusion

When it comes to maintaining healthy teeth and gums, having the right dental insurance is essential for both individuals and families. By considering factors such as coverage options, affordability, and provider networks, you can find the best dental insurance plans that suit your needs. Whether you're looking for a plan that covers preventive care or one that provides more extensive treatments, there are numerous affordable options in 2025. Take the time to compare plans and select one that provides the most comprehensive care for your oral health.

Explore

Affordable Health Insurance Options for Low-Income Families

Why the 2025 Toyota Camry is the Ideal Mid-Size Sedan for Families

Find a Dentist Near You for Dental Care

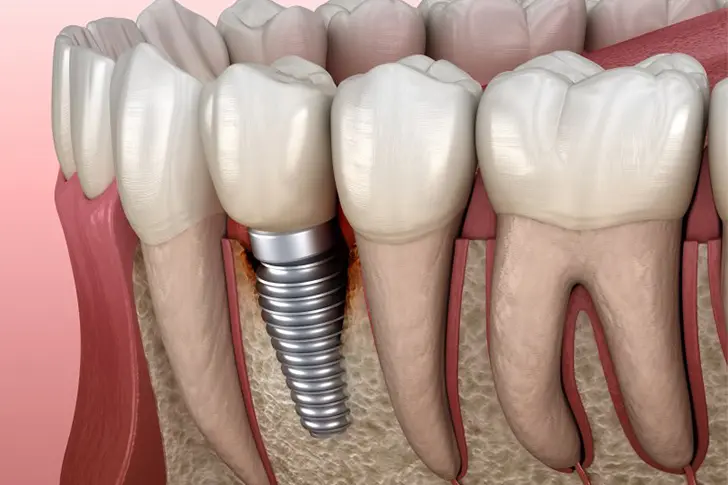

How To Find Cheap Dental Implant

Find the Best Invisible Dental Braces Near You: A Comprehensive Guide

The Best Cell Phone Plans

List of Medicare Advantage Plans 2024 & 2025

How Might US Health Plans Cover Gene Therapies for Sickle Cell Disease?