Purchase Structured Settlements: A Comprehensive Guide

When you decide to purchase structured settlements, you’re entering into a financial agreement that offers long-term stability and a steady income stream. Structured settlements are often awarded to individuals after lawsuits, such as personal injury claims, and are paid out as periodic payments instead of a lump sum. For investors, purchasing these settlements can provide a reliable return on investment, while sellers benefit from immediate cash to meet their financial needs. In this article, we’ll explore the process, benefits, and considerations involved in buying structured settlements.

1. What Does It Mean to Purchase Structured Settlements?

Purchasing structured settlements involves buying the rights to receive future payments from an individual who has been awarded a structured settlement. These payments are typically funded by a life insurance company and can be sold by the recipient for a lump sum.

Key Benefits for Buyers:

- Predictable Income: Receive regular payments over a specified term.

- Stable Investment: Structured settlements are backed by insurance companies, reducing risk.

- Higher Returns: Often offer better returns compared to traditional fixed-income investments.

Key Benefits for Sellers:

- Immediate Cash: Access to a lump sum for emergencies or large expenses.

- Debt Relief: Use the proceeds to pay off high-interest debts or other financial obligations.

2. Why Invest in Structured Settlements?

Structured settlements provide a unique investment opportunity for individuals and institutional buyers. The advantages include:

- Low Risk: Payments are guaranteed by insurance companies with strong financial ratings.

- Consistent Returns: Unlike volatile stock markets, structured settlements offer steady returns.

- Tax Benefits: In many cases, the income received from structured settlements is tax-free.

3. How to Purchase Structured Settlements

The process of purchasing structured settlements involves the following steps:

- Research and Find a Reputable Broker: Work with a broker who specializes in structured settlement transactions.

- Evaluate Offers: Analyze the payment schedule, discount rate, and overall return on investment.

- Verify Legal Requirements: Ensure the sale is approved by a court, as this protects both the buyer and the seller.

- Finalize the Agreement: Once all terms are agreed upon and legal requirements met, the transaction is completed.

4. Comparison of Structured Settlement Investment Options

| Investment Type | Risk Level | Return Potential | Payment Frequency | Best For |

|---|---|---|---|---|

| Structured Settlements | Low | Moderate | Fixed periodic payments | Investors seeking steady, long-term income |

| Stock Market Investments | High | High | Varies | Those with a high-risk tolerance |

| Bonds | Low | Low to Moderate | Periodic interest | Conservative investors |

| Real Estate | Moderate to High | Moderate to High | Rental income or resale | Investors seeking diversification |

5. Factors to Consider Before Buying Structured Settlements

When deciding to purchase structured settlements, it’s crucial to evaluate the following:

- Financial Strength of the Issuer: Ensure the settlement is backed by a top-rated insurance company.

- Discount Rate: This determines the overall cost of the settlement. Lower discount rates are better for buyers.

- Legal Compliance: Verify that the transaction meets all regulatory and court approval requirements.

- Payment Schedule: Assess whether the payment structure aligns with your financial goals.

- Liquidity: Understand that structured settlements are long-term investments and may not offer immediate liquidity.

6. Benefits for Sellers

For individuals selling their structured settlements, benefits include:

- Quick Access to Funds: Ideal for unexpected expenses, such as medical bills or education costs.

- Flexibility: Convert long-term payments into a lump sum for greater financial freedom.

7. Reputable Companies for Purchasing Structured Settlements

When buying structured settlements, it’s important to work with reliable companies. Below are a few well-known brokers and firms specializing in these transactions:

| Company | Services Offered | Reputation | Customer Support |

|---|---|---|---|

| J.G. Wentworth | Purchase of structured settlements, annuities | Trusted brand | Excellent |

| Peachtree Financial | Structured settlement buyouts | Well-regarded | Highly responsive |

| DRB Capital | Lump sum payments for settlements | Strong financial backing | Reliable and professional |

| Stone Street Capital | Customized payment solutions | Positive reviews | Good |

8. Potential Risks of Purchasing Structured Settlements

While structured settlements are low-risk investments, some potential risks include:

- Inflation Risk: Fixed payments may lose value over time due to inflation.

- Liquidity Risk: Structured settlements are not easily converted back into cash.

- Issuer Risk: Payments depend on the financial stability of the issuing insurance company.

Conclusion

The decision to purchase structured settlements is a sound investment for those seeking consistent, low-risk income over time. By carefully evaluating payment terms, working with reputable brokers, and understanding the legal and financial aspects, you can make a confident and informed choice. Whether you’re an investor or a seller, structured settlements offer financial stability and flexibility tailored to meet diverse needs.

Explore

Structured Settlement Annuity Companies: A Guide to Choosing the Right Provider

How to Maximize Your Income with the Best Structured Settlement Annuity Plans

Guide To Choosing The Right Payroll Services For Small Businesses

Cash in Hand: Your Quick Guide to Selling Your House Fast

Guide To Finding The Right Mesothelioma Attorney

Guide To Finding The Right Warehouse Management Systems For Small Businesses

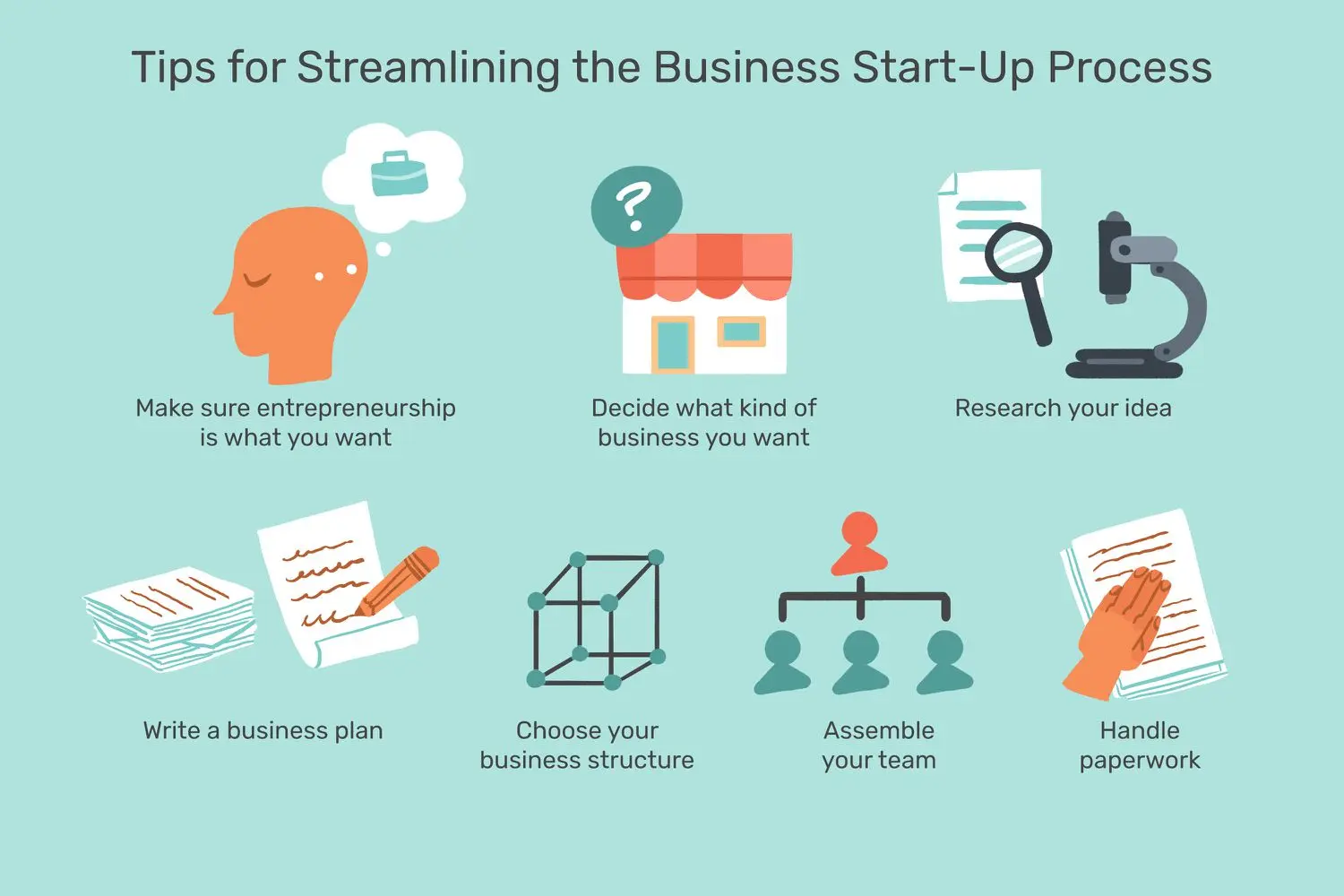

How to Start a Business: A Step-by-Step Guide

How to Get a Medicare Advantage Plan: Complete Guide for 2024 & 2025